This week, from September 28th through October 1st, the North American Blueberry Council and the United States Highbush Blueberry Council Conference and Expo is running virtually with nearly 900 participants, featuring 16 concurrent sessions and 4 keynote speakers. On the first day of the event, one of the sessions, which was presented by North Bay Produce, focused on how consumer purchasing habits have changed due to the pandemic. Speakers discussed shifts in consumer behaviors, media consumption habits, and emerging trends and online shopping.

The rise of frozen blueberries

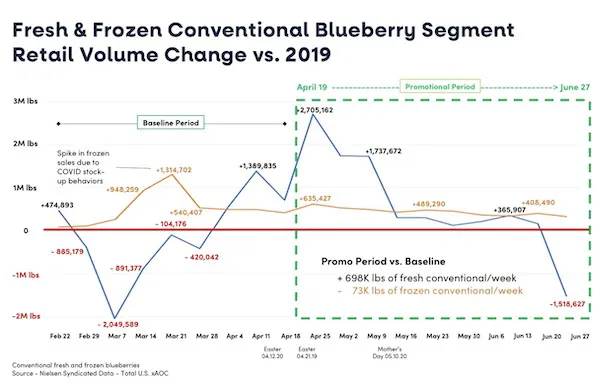

To start off the session, Grant Prentice of Foodminds provided an update on the blueberry industry and the efforts of NACB and USHBC to support the industry throughout the pandemic. “From February to June, there was a pretty significant impact on the market due to the pandemic, specifically from a distribution and supply chain perspective,” Prentice shares. “Retailers and marketers pulled back on investments at this time, and there were many challenges for getting the product into the retail channels. The demand for frozen blueberries rose significantly, as shoppers were stocking up and wanted to buy foods with longer shelf lives. In 2021, one of the focuses for the Council is to put a bigger focus on the integration of the frozen blueberries into their programming.”

E-commerce and Direct-to-Consumer distribution

In addition to the increase in demand for frozen blueberries, the use of e-commerce platforms also grew exponentially. Brendan Kennedy of MNI, a Division of Meredith Corp, shares: “This year saw the first time that mobile spending on groceries surpassed the mobile spending on apparel. The increase in the first quarter of 2020 amounted to +148%. Now, more than half of US adults are spending more on online groceries than they were pre-pandemic, and online grocery retailers saw a 210% surge from March 12th to 15th, 2020.” Melanie Kussell of Instacart also shared: “The online grocery category was predicted to grow from 3% to 30% by 2025. We achieved this growth in a 3-month period when the pandemic broke out, and it’s still evolving today. It will be interesting to see how the developments will continue as we get to the holidays and enter 2021.”

Another new trend that has been brought forth due to the pandemic is that of Direct-to-Consumer distribution. “In the category of Consumer Packaged Goods (CPG), there are great opportunities for those who have their own brand. We found that 60% of shoppers say they would like to buy products directly from brands, but only 16% of shoppers currently do so. So, there is a lot of room for growth in this category. The key takeaway here is that online grocery shopping is here to stay, and as it grows, brands are shifting to direct buying options for consumers,” says Kennedy.

New platforms for reaching consumers

With changes in shopper habits as well as the many other changes that have taken place in the consumer’s daily life, the way that advertisements are dispersed have also changed. Kennedy shares: “People are increasingly using streaming services to watch television and there is a lot of opportunity for targeted advertising on these platforms. You can cut through the clutter very quickly with these options, and we are seeing a shift in placements. Brands are shifting their tactics for connecting with consumers and are using new mediums. Now is also a great time to find partnerships with the various apps out there that are reaching and engaging with consumers in new ways.”

In-store shopping continues

While the e-commerce platform has seen tremendous growth, many shoppers are still going to stores as well. Godwin shared that based off of the user statistics from the Shopkick app, they have seen that 92% of their users are still visiting stores at least once a week. “The big winners in this are the grocery and big box stores. People are no longer interested in going to multiple stores to get what they need; they want to be able to get what they are looking for in one trip. One of the positive results of all of this is that shoppers have bigger baskets and that spending is up – they are buying more items in one big trip, rather than having more, smaller, trips.”

Kennedy adds to this: “One of the changes that has come with this is that people are buying more of what they need, rather than what they want, so there is less impulse buying. But that doesn’t mean that there aren’t still opportunities for impulse buying. One of the categories we’ve seen expand recently is that of snack foods, and this could be a great opportunity for the blueberry industry. It just needs to be clearly communicated to consumers, and we’ll have to find the appropriate strategy for this,” he concludes.

The NABC/USHBC Virtual Conference and Expo will be live through October 1st. Click here to register.