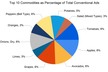

Ukraine's berry exports continue to rise in response to growing global demand, with fresh berry exports up 72% compared to 2022 and frozen exports up 24%. The main importers of fresh berries are Poland (34%) and the Netherlands (28%), both of which have doubled imports from Ukraine since 2022. Frozen berries are mainly shipped to Poland (35%), Germany (23%), Austria (10%), and Italy (8%).

Although production has declined in recent years due to infrastructure damage, labour shortages, and higher input costs, the rate of decline has slowed. The sector's relative stability is attributed to a redistribution of production shares among berry types.

Strawberry

Strawberry production fell by 12% in 2022, but the decline slowed to 4% in 2023–2024. Reduced domestic supply has increased import demand, with Greece supplying 95% of Ukraine's imported fresh strawberries. Exports of frozen strawberries are growing and have surpassed 2023 volumes, although they remain 20% below 2022 levels when pre-war stocks were still being exported. The main markets are Poland (60%) and Germany (10%). Exports of fresh strawberries have declined since 2017, though shipments to Romania in 2024 boosted volumes by 30% over 2023. Imports of frozen strawberries, mainly from Egypt, have tripled.

Raspberry

Raspberry production fell by 7.5% (2.7 thousand tons), with impacts differing across enterprises. Exports of fresh raspberries declined due to smaller volumes and market fluctuations. Poland and the Netherlands remain the main buyers. Imports, primarily of premium varieties from Spain and Morocco, have decreased. Exports of frozen raspberries continue to rise by about 10 thousand tons annually, with Poland (40%) and Germany (30%) the leading destinations. Germany has tripled its imports since 2022, while Belgium, Austria, Italy, and France have also increased purchases.

Currant

Currant production continues to decline by 6–7% annually. Despite this, fresh currant exports have returned to 2022 levels as prices in European markets remain more favourable than domestic ones. Poland imports over 90% of Ukrainian currants, with shipments to Moldova also recovering. Frozen currant exports have doubled from 2023 but remain 40% below 2022. Main markets are Poland (40%), Germany (15%), France (5%), Austria (5%), and Italy (4%). Imports of frozen currants have halved, mainly from Germany (60%) and the Netherlands (40%).

Blueberry (Highbush)

Blueberry production has nearly doubled since 2022, driven by new plantations and higher yields. Exports of fresh blueberries continue to grow by 2–3 thousand tons annually, led by the Netherlands (40%) and Poland (30%). Exports to the UK, Moldova, and Georgia are also rising. Imports of fresh blueberries have halved since 2023, with Spain, Peru, and Morocco the main suppliers. Frozen blueberry exports have recovered to 2022 levels, mainly shipped to Poland (30%), Germany (20%), Austria (15%), and Italy (20%). Ukraine imports only select premium frozen varieties from Poland and Canada.

Source: MLVVN