After two years of above-average apple production, U.S. growers are facing another supply-exceeds-demand season. The production forecast of 11.7 billion lbs. was presented at last week's annual Outlook Conference, organized by the U.S. Apple Association. "There is a lot of information to digest, and opinions differ, but we know we'll be in a supply situation that will be above demand," says Dan Davis with L&M Companies. The big question is how much longer will it take for the industry to correct itself?

Some industry members believe in consolidation and scaling things up, but L&M Companies have a different philosophy. "We feel it is very important to be right sized and for that reason, we are very selective of what we are bringing in, and who we are partnering with," Davis commented. "We just don't want to bring in more apples for the sake of having more apples. We strive to match our production growth to the growth we've achieved on the customer side."

© L&M Companies

© L&M Companies

Under-indexed

L&M is in the fortunate situation that it still has opportunities to grow in the apple category. "Right now, we are under-indexed on apples and pears when looking at our L&M retail customers across all we do in produce. Many of them have room to increase their apple sales volume dramatically with us. This is a great position to be in, and with our goal to grow in a very controlled manner, we will be able to provide our retail partners with the volume they need."

All growers currently represented by L&M are based in the Northwest, in Washington and Oregon. However, apples are distributed nationwide and in an effort to support the apple category as a whole and leverage its national scale, the company is looking to partner with growers outside Washington as well.

Exports

In addition to its national distribution network, exports are an important share of total sales. "We export to all traditional markets, including Canada, Mexico, South America, and Asia," shared Davis. "However, the export market has been a challenge as a result of tariffs, and I feel it is necessary to understand the dynamics better to be able to utilize its full potential. We are looking to be a participant in all regions previously mentioned but would certainly like to take a closer look at the true potential in Asia."

© L&M Companies

© L&M Companies

Effect of Cosmic Crisp on other varieties

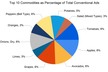

Consumer preferences are shifting, a development to be conscious of. As a result, the varietal make up is changing. Although trending down in volume, Gala is expected to retain the number one position with a production volume of nearly two billion lbs. However, Honeycrisp is getting closer to being the largest variety and is certainly the dominant variety through the eyes of the consumer. After a dip this past season, the Honeycrisp crop is expected to make a comeback in volume. Another variety that is growing incredibly fast is Cosmic Crisp. "This variety has a huge effect on other varieties as it cannibalizes the market share of certain core varieties," Davis said.

The U.S. pear industry is facing a similar situation, expecting a large crop as well this upcoming season. "For both apples and pears, it is important to get to velocity as soon as possible and sell as much product we possibly can while we have the opportunity." To assist their customers in moving as much volume as possible, L&M wants to provide a full solution and be the retailer's partner in the tree fruit industry.

Optimism

The industry as a whole acknowledges that there's oversupply and there's much debate about changing the supply side, which will take a long time. "However, by and large there's optimism in the face of these trying times. While we're 100 percent concerned about profitability, we're also optimistic we'll be able to endure this oversupply problem together."

For more information:

For more information:

Dan Davis

L&M Companies

Tel: (+1) 509-225-2610

[email protected]

www.lmcompanies.com