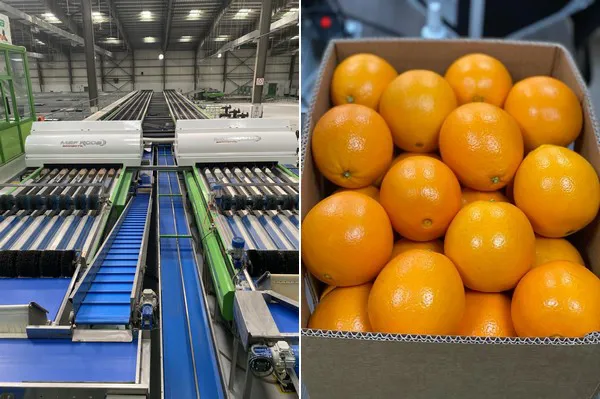

Export volumes for Egyptian oranges have been lower than expected. Most of the oranges are larger sized this year, and demand for these sizes has been lacking. On top of that, Russia has set new rules when it comes to pesticides, which means farmers still have to adjust to follow the new requirements.

According to Abdullah Tharwat, business development manager for Pyramids Agriculture, it’s been a difficult orange season up until this point: “The past two months have seen high demand for smaller sizes of oranges. When it comes to the larger sizes, there has hardly been any demand at all. This leaves every management board in an orange export company with an important question. Do we keep packing the large sizes or do we wait until more markets are opened up to us?”

Although there is more demand for smaller sized oranges, the majority of the oranges from Egypt are large in size. “The Egyptian orange season started in December with the Navel and Baladi varieties. There was a high demand for small sizes of navel, but only 30 per cent of the harvest can be considered small. This leaves 70 per cent of the production of the farm to be larger sized, and as stated there has simply been no demand for these sizes,” Tharwat explains. “For the Baladi variety, the demand was slow compared to the previous season. Some markets still have oranges from the South African season stored in their cold store.”

Overall, the issues have caused a major reduction of export volumes for the Egyptian oranges. “This means we’ve seen a drop of about 40 per cent for export volumes. This is mostly due to the large sizes not being exported, but Russia has also instated new rules in terms of pesticides, which will take some adjustments. As Russia imports about 20 per cent of the total Egyptian orange production every year, this was a major setback for exporters. We hope things get better in the next two weeks, because some markets will finish their local production and China will be a good market now that the Chinese New Year has begun.”

As in the rest of the world, packing and shipping has become more expensive in Egypt as well: “This season, the cost of packing materials has increased around 60$ per ton. On top of that, the shipping cost increased by 50% to even 100% in some markets, when compared to the price of one year ago. All these cost increases will put a high pressure on the price of oranges in the farms. The main challenge in this season will be to handle your production and farm quantities the right way, to plan with your customers week by week, as well as open new markets for the larger sizes of the oranges,” Tharwat concludes.

For more information:

Abdullah Tharwat

Pyramids Agricultural Investment Co.

Cell no: +201005027256

Tel./Fax:0020452633420

Email: Abdallah@pyramids-agriculture.com

www.pyramids-agriculture.com