California almond growers have seen prices improve over the past 18 months, but market data and yield outlooks suggest a non-linear path ahead. Recent shipment figures point to near-term demand softness, while structural changes in acreage and yields are expected to influence supply from 2026 onward.

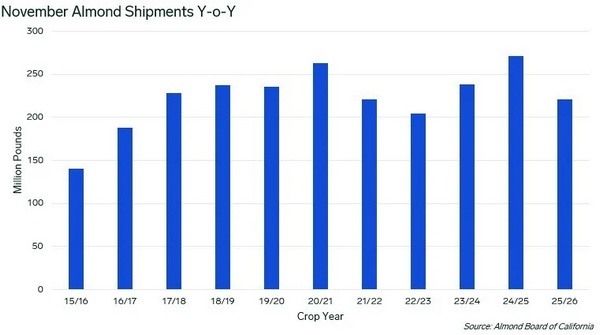

On December 10, the Almond Board of California released its November position report. U.S. almond shipments totaled 220.5 million pounds in November 2025, down 19.0% year on year and well below the market expectation of 251 million pounds. Shipments also fell below the three-year average of 238 million pounds and weakened from October levels.

© Mintec/Expana

© Mintec/Expana

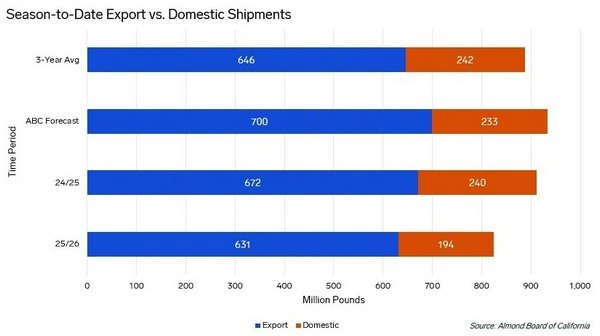

Season-to-date shipments from August through November reached 824.8 million pounds, lagging last season by 9.5% and the three-year average by about 7.1%. Of November shipments, 47.3 million pounds were domestic, down 13.0%, while exports totaled 173.2 million pounds, down 20.2%. Exports still accounted for 77.0% of total shipments season to date, above both the board's 75% forecast and the three-year average of 72%, although export momentum slowed.

India received 26.2 million pounds in November, bringing the season total to 99.0 million pounds, down 19.0%. Europe imported 50.1 million pounds, lifting the season total to 194.2 million pounds, 2.0% ahead year on year. The Middle East reached 39.2 million pounds for the month, with season-to-date shipments at 134.6 million pounds, down 9.0%. China and Hong Kong remained constrained at 2.2 million pounds for the month and 8.6 million pounds season to date, 75.0% lower year on year.

© Mintec/Expana

© Mintec/Expana

Total commitments stood at 545.3 million pounds, down 10.9%. New sales reached 204.3 million pounds, down 2.5% year on year and 22.0% lower than October. Crop receipts totaled 2,187.6 million pounds for the season, down 6.6%, with November receipts at 489.4 million pounds, a 31.0% decline from October.

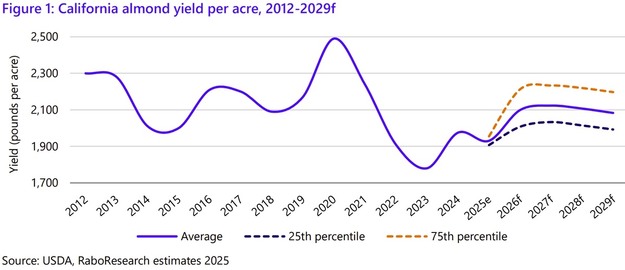

Alongside these near-term indicators, yield forecasts point to medium-term changes. Average yields for the 2022–2025 crop years are estimated at about 1,900 pounds per acre, equivalent to roughly 2,129 kilograms per hectare, with 2025 projected at 1,931 pounds per acre or about 2,164 kilograms per hectare. This compares with an average of 2,199 pounds per acre or about 2,465 kilograms per hectare from 2012 to 2021. Current fully bearing acreage stands at 65% to 70%, and trees are agronomically capable of producing more than 2,100 pounds per acre or over 2,353 kilograms per hectare from 2026 onward.

© Rabobank

© Rabobank

Yield potential is expected to peak around 2027 before easing as older orchards are removed. Nearly 500,000 bearing acres, or about 202,343 hectares, are not yet at full production. Market participants broadly expect supply constraints to remain supportive, while demand indicators continue to be monitored closely through the remainder of the season.

Source: Mintec/Expana

For more information:

For more information:

Rabobank

Tel: +31 30 2162758

Email: [email protected]

www.rabobank.com