Moroccan blueberry exporters have increased shipments to Canada between July 2024 and June 2025. According to EastFruit, Morocco exported 1,900 tons of blueberries valued at more than US$19 million. This was nearly double the previous season's volume and about 17 times more than three seasons ago. The average annual growth rate during this period reached almost 160%.

Morocco first exported blueberries to Canada in 2008, but regular shipments only resumed in the 2021/22 season. Canada is therefore still considered a relatively new market for Moroccan blueberries.

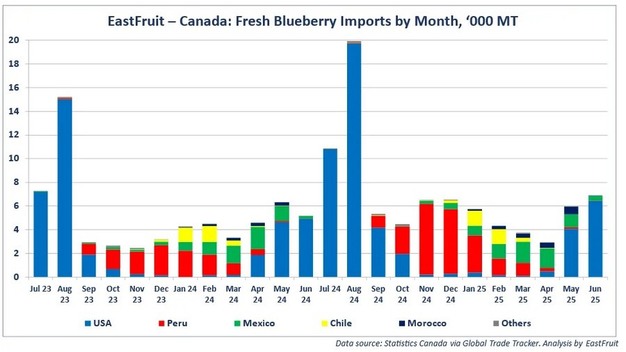

The United States continues to be the main supplier to Canada, covering more than half of the total imports. Peru accounts for about one-quarter, while Mexico, Chile, and Morocco make up the rest. Morocco's market share has increased from 0.16% in 2021/22 to 2.3% in the most recent season, in line with rising volumes.

Canada recorded higher import demand for blueberries in the 2024/25 season across most suppliers, except Chile, where exports declined for the fourth year in a row. The country's peak import season runs from July through August, supplied mostly by the U.S. Moroccan exports are concentrated between December and June, with volumes peaking in April and May after Peru's season ends and before U.S. shipments reach their highest levels. During this period, Mexico and Chile also supply the Canadian market, positioning them as Morocco's direct competitors.

Morocco's entry into Canada reflects its growing role in the North American blueberry trade, complementing its existing position in Europe. In addition to its expansion into Canada, Morocco also set new records for blueberry exports to the United States during the same season.

Source: EastFruit