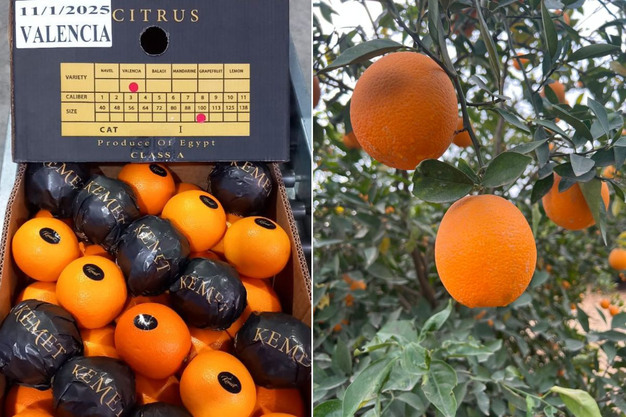

The Egyptian Valencia orange season begins promptly, with fruit already arriving in packing houses. According to Mostafa Ali from Premium Sourcing, the export campaign is shaping up to be more successful than the previous one, although it's expected to be tough and shorter than usual.

The exporter says: "Some packing houses are getting ready to load this season's Valencia oranges, and others will join soon. This is a slightly earlier launch than usual. The effective start of the season, which is also the best timing when it comes to coloring, acidity, and sugar levels, will be at the beginning of February. I'm delighted that the quality is very good this year. Growers have done a very good job, and we're seeing a lot of progress in compliance with MRLs. Growers are increasingly knowledgeable and we making real progress in this area."

Unlike last season, which saw a huge production, the current season does not entail the risk of oversupply, according to Ali. "Many experts and large-scale growers agree that volumes of Valencia oranges at the national level have fallen this year, to the point of shortening the season. We usually export until mid-June, but it is expected that the campaign will end at the end of April this year."

"It's not bad news," continues Ali."last season was very tough, as oversupply coupled with the Red Sea crisis plummeted prices. Marketing-wise, this season looks set to be much better."

Egypt will be competing with Spain on the global market, and it will not be an easy challenge for Egyptian exporters, according to Ali. He explains: "There is no shortage of oranges in Spain or only a slight one. The floods in Valencia didn't have the same impact on oranges as they did on mandarins. Not only will the competition be tough, but Spain will not import as many Egyptian oranges as some exporters are hoping."

The market distribution between Egypt and Spain will be determined by the size factor, and this is where things will be difficult according to Ali: "We don't have many large calibers this year. The 42, 48, 56, and 64 sizes don't exceed 10% of production, while the medium sizes, 72 and 80 account for 40%, the rest half being small sizes of 80, 88, 100, 113, and 125. This means that key markets such as the Netherlands, the UK, Brazil, Russia, and the United Arab Emirates will be difficult to supply. Egyptian exporters will be faced with a tricky choice of destination for the large-caliber oranges they have available. On the other hand, things will be easier in markets that prefer small and medium sizes, such as India, Bangladesh, Malaysia, Singapore and other Asian markets".

Egyptian exporters' performance in the Asian market will depend, however, on the situation in the Red Sea, which is why last year's campaign was a total disappointment. Ali remains cautiously optimistic: "recent developments in the region indicate that the crisis in the Red Sea is on its way to resolution, but we don't know how long it will take, nor how fast shipping companies will return to normal operations."

All in all, despite the size and shortness of the season, things are looking good for Ali: "I can already see the first signs of good demand. The proof is in my busy schedule at Fruit Logistica, with many potential buyers from European and Asian markets."

For more information:

Mostafa Ali

Premium Sourcing

Tel: +20 10 07350313

Email: [email protected]

www.premiumsourcingco.com