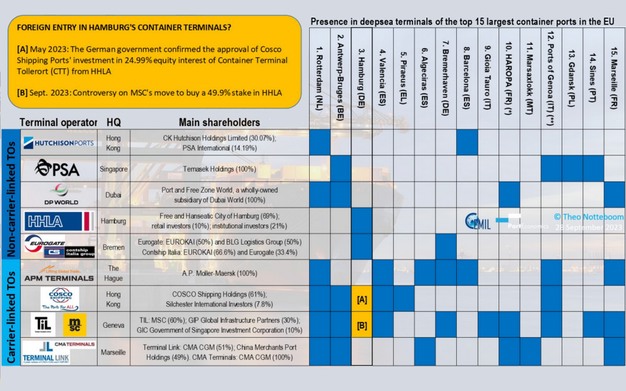

PortEconomics member Theo Notteboom reviews the presence of the leading global container terminal operators in the top 15 European Union (EU) container ports, based on 2022 TEU figures.

The blue boxes on the following table refer to all types of direct or indirect terminal involvement, such as full ownership, joint venture, or a majority/minority shareholding. A distinction is made between carrier-linked (bottom) and non carrier-linked (top) terminal operators.

Additionally, the table puts the current controversy in Hamburg on MSC’s offer to buy a 49.9% share in HHLA, Hamburg’s largest box terminal operator, somewhat in a better perspective.

Only a year ago, there was a political controversy concerning the possible involvement of Chinese shipping giant COSCO in Hamburg's Tollerort terminal. Eventually, in May this year, the German government confirmed the approval of Cosco Shipping Ports’ investment in 24.99% equity interest of Container Terminal Tollerort (CTT) from Hamburger Hafen und Logistik Aktiengesellschaft (HHLA).

If MSC’s deal in Hamburg goes through, both Cosco and MSC (directly or via its port operating firm TiL) will have secured a presence in the top four container ports in the EU.

For more information: container-news.com