US almond prices fell to 20-year lows this week as concerns over large ending stocks weighed on markets ahead of harvest. The Mintec Benchmark Prices for standard 5% almonds FAS US [Mintec Code: NAL1] were assessed at $1.40/lb on 3rd August 2023, down 7 cents/lb on the week and the lowest price for the Benchmark since January 2003.

Trading was reported at $1.43-1.45 in the first part of the week before falling to $1.40/lb during trading on Wednesday and Thursday.

The drop was put down to store clearing activity with some sellers who still possessed large volumes of standard 5% material looking to free up space ahead of harvest.

Despite the low prices, the appetite for these supplies was mixed with holidays in Europe and ample supplies at destination, limiting demand.

“We sold some standards at $1.40.lb earlier in the week, but now we are sitting on offers at the same level, and we can’t find a buyer. I wouldn’t be surprised to see prices drop further unless buyers start engaging with the market,” a European trader disclosed to Mintec.

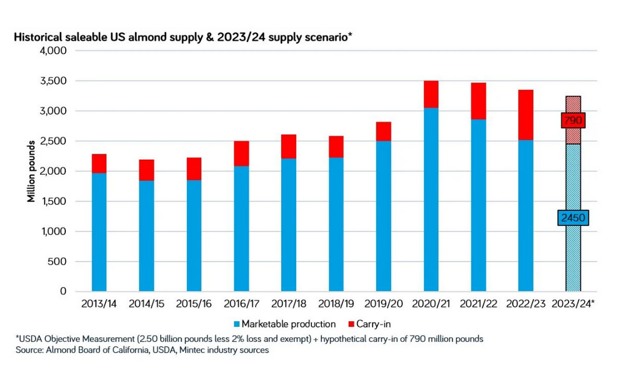

Looking further forward, market participants expect supply to continue to outweigh demand with an expectation of stocks close to the 800 million pound mark (read more here) and a USDA Objective Almond Measurement of 2.50 billion pounds placing total supply north of 3 billion pounds for the 2023/24 season.

Market expects 2022/23 almond ending stocks close to 800 million pounds

Market expects 2022/23 almond ending stocks close to 800 million pounds

Market participants surveyed by Mintec in the first week of August were expecting a year-on-year increase in July shipments ahead of the July position report, which is due for release on 11th August.

Estimates for July almond shipments were reported in the range of 170-200 million pounds, with most market participants returning figures of 175-190 million pounds. If realised, a July shipment figure of 180 million pounds would be an increase of 6% y-o-y, 7% below the three-year average (2020-2022) for the month.

“We saw a large increase in activity over the last two weeks in July which helped lift our export figures. This appears to be the case for most we spoke to; they are up year on year, with a slow start to July and a strong finish. Luckily August seems to be keeping up the momentum; low prices are good for something, I guess,” a US handler said to Mintec.

For more information: mintecglobal.com