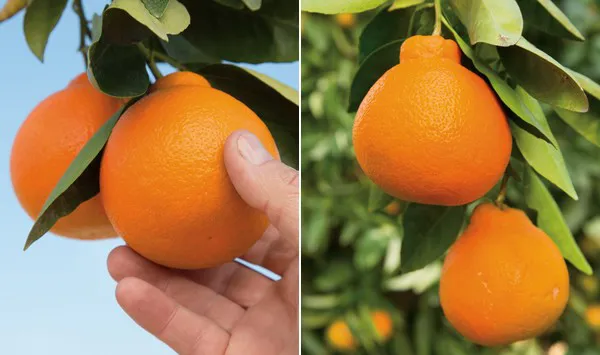

Are Minneolas a forgotten piece of citrus? On paper, perhaps.

As Zak Laffite, president, Wonderful Citrus notes, in the citrus category, the item that’s the size of an orange but peels like a mandarin represents only about one percent of total citrus sales and approximately 5,000 acres of the 300,000 citrus acres stretching across California.

“If you look at the acreage across California, it has declined about 10 percent over the last four years. A lot of the acreage in the ground is at least 30 years old and there haven’t been a significant number of new plantings,” he says.

Yet, then there’s demand for Minneolas. “People who like them are crazy about them. They feel it’s the undisputed best piece of citrus so it has a passionate consumer base,” says Laffite. “That passionate following is why you continue to see it in the marketplace.”

International item

Minneolas have also become as much of an international item as they have a U.S. item--approximately 50 percent of California production is exported to Japan and Europe. “Minneolas as a portion of total production is the highest exported item in California citrus. Oranges are at 30 percent, lemons 15-20 percent and mandarins are less than five percent. It’s an overseas product as much as it is domestic,” Laffite says. He also notes that both Japan and Europe have supply chains that have also stabilized which makes it easier to count on demand for the fruit.

The fruit is also fairly California-centric at this time of year with Peru and Australia also producing Minneolas but in the summer counter seasons to California’s winter citrus season.

This year’s crop of Minneolas is similar to last year, though production started later largely due to initial higher acid levels. “We held off a little longer to give the fruit time to get to its optimal eating quality and that cost us about a week,” he says. The season begins in late January and runs until late April.

Even with its dedicated audience, this year’s demand is slightly sluggish though that’s consistent with the entire citrus category. “The overall category, if you look at it in retail, it’s down maybe 6.5 percent. February was a tough month for orange sales,” Laffite says. “This year, Minneolas are behind last year’s pace by maybe 20 percent. We also started later so we may catch up at the end of April.”

2023 pricing

Pricing is also down slightly though that’s by market--while export pricing is down about 10 percent, possibly attributed to smaller fruit that commands a lower price or a strong U.S. dollar, domestic pricing is up by about 10 percent over last year.

Given all of this, there are questions about the long-term future of Minneolas. The citrus category and produce in general continue to be challenged in terms of shelf space. “I liken Minneolas to grapefruit--they have their own following but it’s not a widely purchased item so how do you justify the shelf space? Also, does it also garner the need to have promotions to drive demand?” says Laffite.

Those 30-year-old plantings are also on watch given some of them are on the lower end of productivity due to their age. “Is there a strong position to survive? To endure stronger costs and higher price competition? You have to be productive and give yourself the best possible chance,” he says. “We’ve managed pricing to keep Minneola growers profitable but how much of that will you be able to do in the next five to 10 years as those acres get older and maybe start declining in productivity? That’s what we’re looking at from a long-term perspective.”

For more information:

For more information:

Lauren Cleaner

Wonderful Citrus

lauren.cleaner@wonderful.com

https://www.wonderfulcitrus.com/