This week’s PMA virtual town hall focused on AgTech investing. Vonnie Estes, PMA’s Vice-President of Technology led Ingrid Fung, Investment Director with Finistere Ventures, Jaqueline Heard, Founder and CEO of Enko Chem Inc., and Han Chen, Co-founder and CEO of ZeaKal Inc. in a discussion about what investors are looking for in start-ups, how 2020 went for start-ups and getting funding.

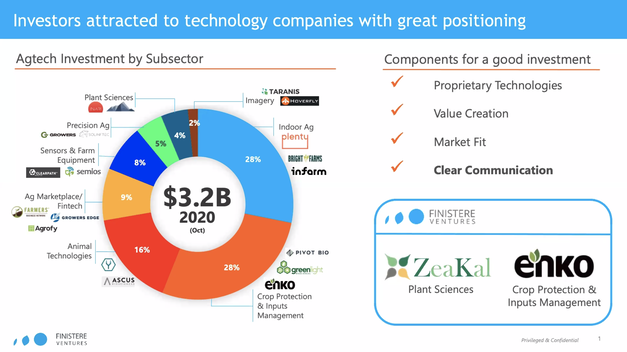

To start off, Ingrid provided an overview of the AgTech investments over the past years. “Finistere Ventures is an early stage AgTech investment fund, which means we invest into start-ups that have technology in agriculture. Over the last 10 years, AgTech investment has shown incredible growth, going from less than a 100 million invested annually to about 3.2 billion invested over the first three quarters of 2020. A lot of this growth has to do with generalist investors moving into the space and an increased interest from private equity groups and pension funds to invest in agriculture with a sustainability lens.”

Top: Vonnie Estes and Ingrid Fung. Bottom: Jaqueline Heard and Han Chen.

2020: A year of growth and reflection

The pandemic, surprisingly, did not stunt investment growth. “Going into 2020 from 2019, we expected another banner year. After all, 2019 saw about 2.7 billion in investments in the sector. Then, when Covid hit, we weren’t really sure what to expect. But, to our surprise, Covid had the effect of accelerating investments into AgTech as investors sought to bridge their companies beyond the impact of the pandemic, and consumers became increasingly aware of food supply chain challenges and risks,” Fung explains.

Heard’s company Enko Chem closed a round of funding in the summer of 2020. She shares: “We started raising in the fall prior to the pandemic, so we were able to start off in a normal environment. The start of the pandemic was tough but then things opened up a bit and, in the end, Zoom was a huge benefit to us: it makes it easier for you to get onto someone’s calendar and give your pitch. There are, of course, also new challenges with this format. For example, it is much more difficult to do your due diligence and build a relationship with a potential investor – it is so important to have that rapport and the relationship and that takes time to build. But overall, it was a great year in terms of Ag and for investors to come into the space, so I feel very encouraged for the future for AgTech.”

For Chen and his company ZeaKal, 2020 was a year to connect to the supply chain and reassess their priorities and goals. “We went into 2020 expecting an upward trajectory, but then the pandemic hit. February and March were spent seeing which of our operations had to shut down and adjusting our milestones and managing expectations. But CEOs in start-ups rarely get any quiet time because of the constant pressure and focus required. Because of the pandemic, we were able to take a step back and figure out what we really wanted to achieve. It allowed us to broaden our focus and speak to the supply chain and see what innovations are really needed. Our focus right now is on row crops, but we are seeing a lot of disconnect in the value chain which has led us to the conclusion that, in addition to perfecting the science, we also had to innovate our business model. So, we have now launched two major initiatives to build an entirely new supply chain from the ground up, based on the pillars of sustainability.”

Marketing and messaging become increasingly important

Fung explains that there are a few things that investors look for in a start-up when they are deciding if they want to invest. “First of all, the company needs to have proprietary technology, but they also need to create value and have a good fit with the market. But it has also become increasingly important to have clear communication and positioning in terms of their products and values. Clear communication and brand positioning are key to success, and a digital presence is an important aspect of that; it helps you stand out from the crown and is a way to capitalize on a captivated audience – especially during the pandemic,” she shares.

Chen agrees, adding: “One of our investors was very focused on marketing and branding, and that translated really well into our company. Prior to working with them, we had none of the digital assets; we weren’t really on Instagram or Twitter. We were doing great things, but we needed to get into the hearts of people – not just their minds. We thought that data speaks for itself, but it doesn’t: it needs to be explained in a meaningful way to be truly impactful. That is why I would also always recommend finding an investor who does more than just bring capital.”

“A huge role of start-ups is to disrupt the supply chain,” Heard says. “So far, for us, the reception has been welcome. We are just starting out on our branding journey, but transparency is going to be essential. We recognize that consumers are key stakeholders, even though our customers are growers. We see the role of the small start-ups as bringing awareness of technology to the industry and show the impacts it can have on sustainable agriculture. Our role is to look at agriculture 10 years from now and consider what it could look like – then develop technologies that could service that future. It can be scary, but it is also exciting,” Heard concludes.

Next week's PMA virtual town hall will explore diversity and inclusion resources for PMA members.