European physical markets

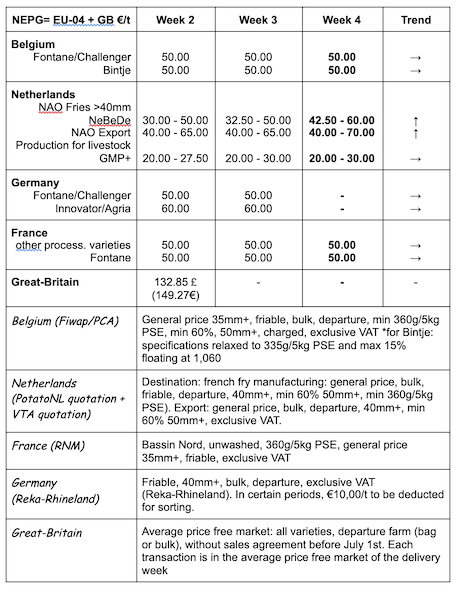

Price summary €/t (source: NEPG):

Belgium

Fiwap/PCA market message:

Potatoes for processing: little trade reported. Several factories are still buying to supplement their contracted supply. Very little offer (the low prices tend to limit the offer), which mostly includes the (last) batches that are not treated with anti-germinatives. Despite the low activity, prices remain sustained overall for the 3 main varieties.

Bintje, Fontane, Challenger: 5.00 €/q.

Bintje plant: little trade but prices are firm. The small calibers are difficult to find (almost no offer). Dutch/French/Belgian plant, class A, returned March 2021, by 10 tons, in big-bags excl.VAT:

Caliber 28-35 mm: For the moment, no quotation due to lack of offer;

Caliber 35-45 mm: 50.00 to 55.00 €/q, firm prices.

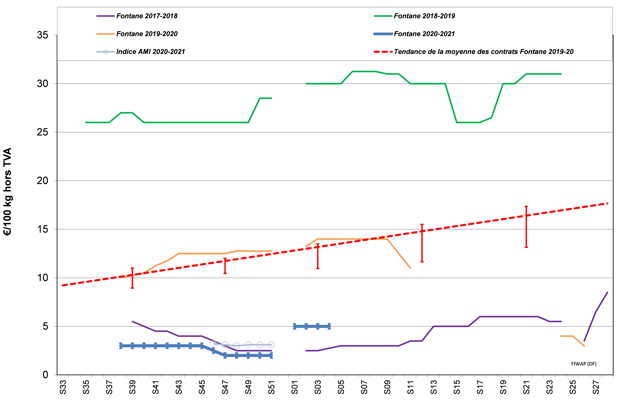

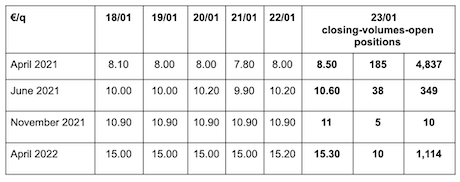

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for transformer, 40 mm+, min 60 % 50 mm +:

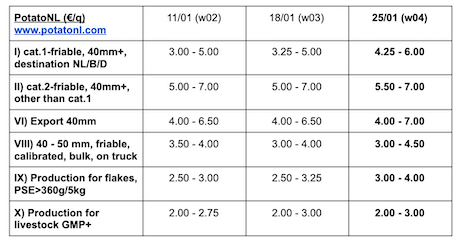

Netherlands

The price increase at the beginning of the month has been fully absorbed. The markets were unchanged last week, awaiting new developments. As in Belgium, the average price for the processing potato was around 5.00 €/q for immediate delivery for the basic varieties, with transactions at higher prices already for more specific varieties (Agria, Markies type). Some transactions also observed at 6.00 - 7.00 €/q for delayed delivery (February/March), and 8.00 to 11.00 €/q for April-June. The fresh domestic market remains sustained due to the lockdown and the good demand from retail. The firm flesh varieties maintain a price of 12.00 to 18.00 €/q, and the mealy varieties between 10.00 and 14.00 €/q. Export is still not very dynamic despite the low prices (4.00 to 7.00 €/q at the producer).

France

Processing market: less sustained purchases last week, perhaps due to the second lockdown in place in several European countries (Netherlands, Germany, United Kingdom and France) or the bleak perspectives regarding the reopening of out-of-home catering. The main industrial buyer still shows 5.00 €/q (all varieties). We still note some purchases through intermediate trade at higher prices (6.00 €/q), while the difficulty to meet the contracts for some varieties also feeds a parallel demand. On the fresh domestic markets, prices are stable, or slightly up. Export remains turned to Spain and Portugal; Romania is present intermittently. Prices are disputed for the lower and intermediate quality (max 10.00 €/q), and remain firm for the higher quality (15.00 to 23.00 €/q in top washable Agata for example).

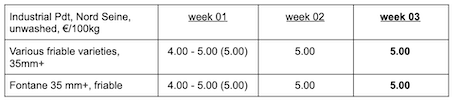

Industrial production, bulk, departure, excl.VAT, Nord-Seine, €/qt, min - max (moy)(RNM):

Germany

Fresh markets (early and semi-early): unchanged prices for firm flesh: 10.83 €/q (10.83 €/q, before last quotation) and also unchanged for soft/mealy flesh: 10.25 €/q (10.25 €/q, before last quotation). At the beginning of February, the stocks in crates will start to take over the stocks in bulk, and some price increase should be applied to the merchandise in refrigerated crates (for the best qualities). Negotiations in progress with the buyers. In the southwest of the country (Saarland, Baden-Württemberg), the French origins are increasing, as they do each year in the middle of the winter.

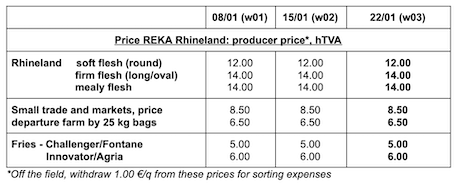

Processing market: firm market and stable prices: 6.00 €/q for Innovator/Agria (6.00 last week), as well as for Challenger/Fontane at 5.00 €/q (5.00 last week). More defects are observed and more batches than usual are being turned to other uses (biogas, livestock, flakes…), but prices remain stable. Firm prices, and slightly up for the crisps varieties. Between 7.00 and 11.00 €/q.

Organic potatoes: unchanged producer prices around 41.00 €/q (all varieties and markets combined), returned trade. Expected increase...

Great Britain

Average price free market for the week ending on January 16th, 2021: 13.29 £/q [14,93 €/q], a 8% decrease (14.40 £/q last week).

Fresh markets (retail): in many sectors, the demand has not increased much compared to last week. The retail markets have been running thanks to the stocks leftover from Christmas, so we can hope for a slight revival of the demand in the near future. Wholesale markets: in the past few months, more and more fish&chips shops have registered on popular takeaway sites in order to attract more clients during lockdown. The demand is calm in January, but these measures could help the businesses gain new customers. Prices have remained stable overall despite the decrease in volumes observed, from 11.25 to 18.75 €/q (calibrated in bags), depending on variety and quality. Markies, Agria and Sagitta benefit from the best prices. Export trade has been somewhat disrupted by the additional controls, although trade continues to Ireland and the Canary Islands.

The processing markets have been affected by the closure of schools, with demand coming only from additional volumes for contracts. However, some universities provide warm meals to employees and students which helps maintain a minimum level of consumption. Continued demand for Maris Piper, especially for prepared meals and other processed products. The offer is said to be increasing and prices vary widely between 4.50 and 12.50 €/q for Maris Piper, and between 4.40 and 6.90 €/q for the white varieties.

Stocks at the end of November (source: AHDB) were estimated at 3.27 Mt, which is 12.5% higher than in 2019 (+363,000 tons), and 4.7% higher than the average of the past 5 years (+147,000 tons).

Amid these stocks, there is a 12% decrease of potatoes for processing compared to last year, with less than 800,000 tons. This is due to a weaker initial production, but also to losses in the fields (difficult grubbings) and the forced marketing of batches with poor storage life. However, uncertainty remains for the rest of the season, because the lockdown reduces the demand for finished products (closure of restaurants and collective catering). On the other hand, the retail sales of fresh potatoes (at the farm or in supermarkets) are expected to be up thanks to the lockdown.

For more information:

FIWAP

www.fiwap.be