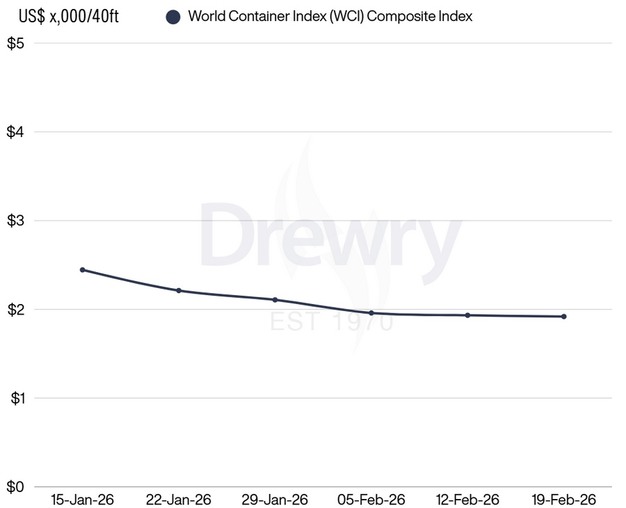

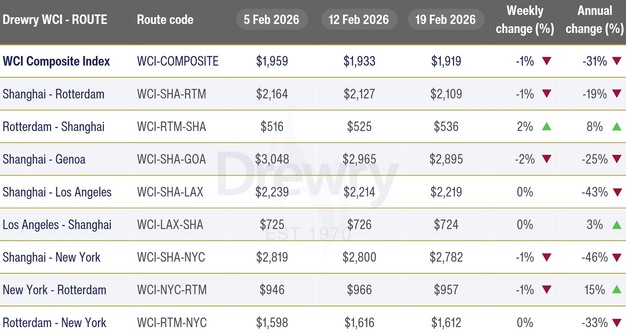

The Drewry World Container Index declined 1 percent to US$ 1,919 per 40ft container, marking the sixth consecutive weekly decrease. The drop was driven by lower spot rates on the Transpacific and Asia–Europe trade routes.

© Drewry

© Drewry

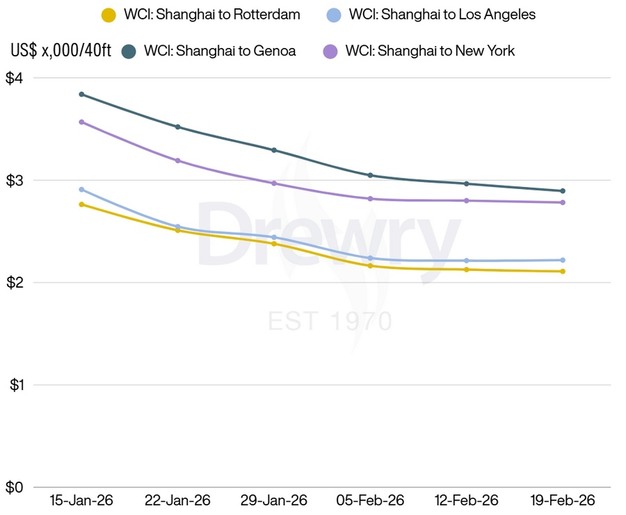

Spot rates from Shanghai to New York fell 1 percent to US$ 2,782 per 40ft container, while rates from Shanghai to Los Angeles remained stable at US$ 2,219 per 40ft container. Carriers are managing capacity to balance supply and demand by announcing blank sailings. According to Drewry's Container Capacity Insight, 31 blank sailings have been scheduled for next week on the Transpacific East and West Coast trade lanes, which is higher than in previous years. Drewry expects spot rates on this route to continue softening in the coming weeks.

© Drewry

© Drewry

On the Asia–Europe trade, spot rates also declined. Rates from Shanghai to Rotterdam fell 1 percent to US$ 2,109 per 40ft container, and rates from Shanghai to Genoa dropped 2 percent to US$ 2,895 per 40ft container. Container Capacity Insight reports that 8 blank sailings have been announced for next week on the Asia–Europe and Mediterranean trade routes due to market volatility and continued factory closures related to the Lunar New Year. Drewry expects spot rates on this trade to decline slightly in the coming weeks.

© Drewry

© Drewry

Container spot rates are declining, indicating weaker market conditions, despite expectations of rising demand and higher rates ahead of the Lunar New Year. This year, rates reached their peak earlier than usual, and if seasonal patterns hold, further declines may follow.

© DrewryFor more information:

© DrewryFor more information:

Drewry

Tel: +44 (0) 207 538 0191

Email: [email protected]

www.drewry.co.uk