Mango shipments for the week ending November 1 totaled approximately 1.93 million boxes, reflecting the seasonal shift from Mexico to South American origins. Ecuador led supply with around 1.53 million boxes, consistent with the peak of its November program. Brazil shipped roughly 291,000 boxes, and Peru continued its early-season increase with about 88,000 boxes. Late-season Mexico (irradiated) contributed 26,000 boxes as its season approaches closure.

Season-to-date volumes show the broader transition in supply regions. Mexico has reached 9.53 million boxes for the season. Brazil stands at 8.80 million boxes, approaching its projected 9.2 million and representing approximately a 5 per cent year-over-year increase. Ecuador's cumulative volume has reached 5.02 million boxes, with full-season expectations near 14.6 million boxes, approximately 0.2 per cent below last year. Peru has shipped 255,000 boxes since starting in mid-October and will continue into early April. The overall Peruvian crop is expected to be about 22 per cent lower year-over-year, indicating a tighter supply later in the season.

© Mintec/Expana

© Mintec/Expana

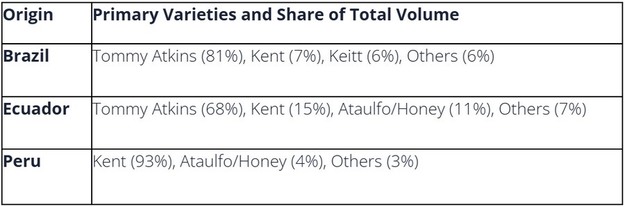

Varietal availability continues to shift as regional seasons progress. Brazil relies heavily on Tommy Atkins, which accounted for 81 per cent of its volume last season. Ecuador also leans on Tommy Atkins, but with a broader mix, including Kent and Ataulfo/Honey, with Tommy representing 68 per cent last season. Peru's season will bring increased Kent availability later in the winter window; Kent represented 93 per cent of Peruvian production last season. This is relevant for programs that prefer Kent for its sizing and flavor profile during mid to late winter.

Ecuador is expected to remain the dominant supplier through December, after which the market will rely more on Peru, despite Peru's lighter crop outlook. Brazil's participation will decline by late November, reducing Tommy Atkins volume. With Peru forecasted to be lighter, and if demand remains steady, some market participants expect tighter supply conditions later in the season.

For now, supply remains stable, but projected lower Peruvian output may influence pricing and availability as winter progresses, particularly for premium varietals and larger fruit sizes.

Source: Mintec/Expana