When we talk about small citrus fruits, we are referring to a group that is fundamental to our market. However, examining the numbers in Italy (2025 data) reveals the clear frontrunner: the clementine. It accounts for an impressive 74.7% of the total production of small citrus fruits, amounting to 826,690 tons. In the contemporary commercial context, the terms 'clementines' and 'small citrus fruits' are often used interchangeably, reflecting consumer and buyer perception rather than strict botanical classification. The defining trait of the clementine, setting it apart from similar fruits, is its ease of consumption. Its naturally easy-to-peel nature has made it a popular choice that aligns with contemporary consumer preferences and attracts a wide range of age groups, including younger demographics. This ease of use is a key marketing advantage that can be leveraged to create growth opportunities.

During the conference "The Clementine of Calabria: Reality and Prospects," held as part of the Clementina Festival, Mario Schiano Lo Moriello, a fruit and vegetable market analyst at Ismea, proposed an in-depth analysis of the current positioning of Italian clementines, specifically those from Calabria, within the competitive European context. He stated that "Italy's strength in the clementine sector is not evenly distributed across the territory, but rather, it is heavily concentrated in specific geographical areas." According to national statistics, the small citrus fruits sector is of great importance to Italian agriculture, with clementines clearly leading the way."

© Maria Luigia Brusco | FreshPlaza.com

© Maria Luigia Brusco | FreshPlaza.com

The pivotal role of Calabria

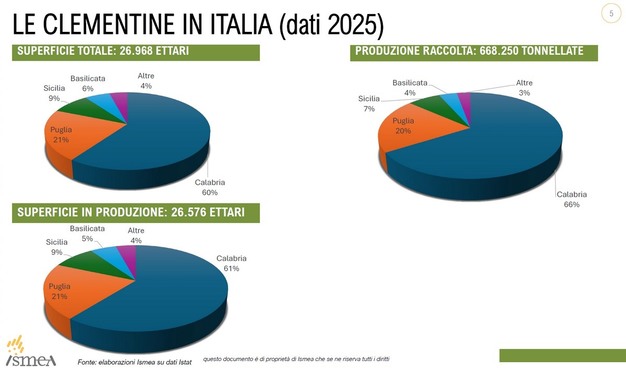

Data from 2025 shows that Italy has designated a total of 36,100 hectares for small citrus fruits, 26,968 of which are specifically allocated for clementines. "About 81% of the total production comes from clementines," Schiano continued. "Within this national context, Calabria emerges as the production hub whose performance determines the competitiveness of the entire Italian supply." The region produces two-thirds of all Italian clementines. Over the past 10 years, the dedicated surface area has remained stable at around 16,000 hectares. Over the past five years, Calabrian production has stabilized at approximately 450,000 tons, though there have been fluctuations due to climatic factors. The province of Cosenza leads the nation with 12,350 hectares, followed by Taranto in Puglia with 5,600 hectares and Reggio Calabria with 2,350 hectares.

© ISMEA

© ISMEA

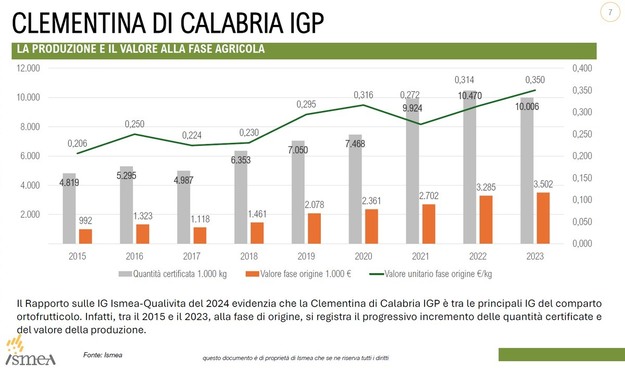

In addition to its production volumes, Calabria boasts qualitative assets of great strategic value. The Calabria PGI Clementine, for example, is a powerful link between product and territory. This Protected Geographical Indication quality mark has shown consistent and positive growth, with certified quantities surpassing 10,000 tons and an estimated production value of around 3.5 million euros. "This shows that it is an important part of the market," said Schiano.

"The presence of regional expertise in organic production is equally crucial. Calabria accounts for nearly 60% of Italy's organic small citrus fruit production, with 5,600 out of 10,000 total hectares nationwide (data from the 2024 Ismea-Qualivita PGI Report). This primacy is not merely a quantitative phenomenon, but also a strategic competitive advantage." Schiano points out that achieving organic certification is essential for accessing high-value markets, such as those in Scandinavia. Additionally, it can serve as a roadmap for the region's entire production, including conventional production, thereby improving the overall offering.

© ISMEA

© ISMEA

The European market: Competitive scenario and trade flows

Analyzing the European market is crucial because the European Union is the primary market for Italian clementines and a key point of comparison. Understanding overall trade flows, key competitors, and logistical hubs is essential for identifying threats and opportunities for growth and market positioning.

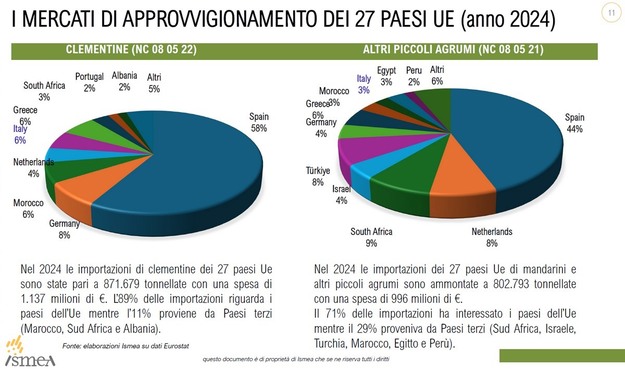

In 2024, the EU-27 exported approximately 1.4 million tons of citrus fruits. Eighty-two percent of those exports went to other EU countries, and 18% went to non-EU countries. That same year, EU-27 countries imported approximately 1.7 million tons of small citrus fruits. Eighty percent of this quantity was related to intra-European trade, while the remaining 20 percent was related to imports from non-EU countries. Specifically, in 2024, the EU's trade with third countries included exports of 250 thousand tons and imports of 335 thousand tons, resulting in a deficit of approximately 84 thousand tons. In terms of value, the EU's 27 member states had a balance of minus EUR 78 million, stemming from EUR 315 million in exports and EUR 394 million in imports.

© ISMEA

© ISMEA

A few large operators with strategic business models control the European market's supplier landscape. Spain is the unrivaled market powerhouse, as well as the world's largest producer and exporter. All other producers must compete against this benchmark. Morocco is another significant producer in the Mediterranean region that exerts strong competitive pressure. Although not producers, Germany and the Netherlands play a crucial role as logistical hubs, importing products, particularly from the Southern Hemisphere, and redistributing them to the rest of Europe. Italy must study and replicate this logistical model to overcome its seasonal limitations, change its role from producer to manager of product flows on a European scale, and compete with Spain and Morocco.

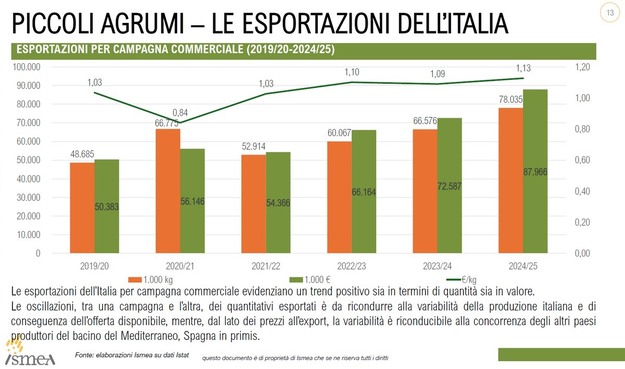

Schiano first examined the general European context, then focused on Italy's specific performance in foreign trade. Recent trends in Italian clementine exports are encouraging, with growth in both quantity and value. Recently, revenues from foreign sales reached approximately EUR 88 million, demonstrating the product's ability to gain a foothold in markets. However, a significant issue is evident from a pricing standpoint, that is, Italy is in a secondary position compared to Spain. "Spain's dominant role in the European market sets the price levels, compelling Italian operators to adjust to a market they can't directly influence."

© ISMEA

© ISMEA

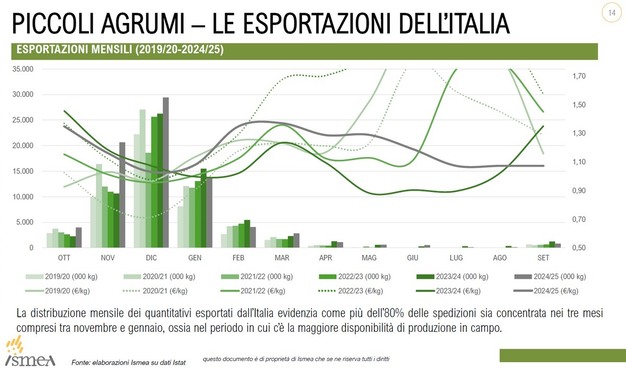

The monthly analysis of exports reveals an issue that significantly impacts Italian trade performance. Over 80% of exports are concentrated in just three months: November, December, and January. This extremely narrow trade window limits sales potential and continuous market presence. It's not just an inefficiency; it's a strategic vulnerability that makes the Italian supply chain susceptible to market shocks and reduces its earning potential. "Varietal innovation is no longer just an option; it's an imperative," Schiano emphasizes.

© ISMEA

© ISMEA

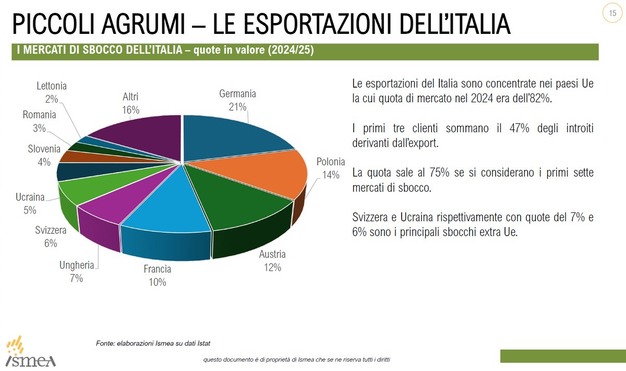

Italy has developed a diverse set of target markets, yet there is still untapped potential. Germany is the largest market for Italian clementines, accounting for 21% of sales. However, this is a smaller share than Germany represents for other Italian fruit and vegetable products. This highlights Italy's well-diversified export portfolio. Italy has a strong presence in Eastern Europe. Poland (14%) is the second-largest customer, followed by Hungary, Slovenia, and Romania. Austria represents 12% of the market. Switzerland and Ukraine are the main non-EU markets, with shares of 7% and 6%, respectively. Schiano describes the UK as "the big absentee." He adds that it represents a significant growth opportunity currently dominated by Spain.

© ISMEA

© ISMEA

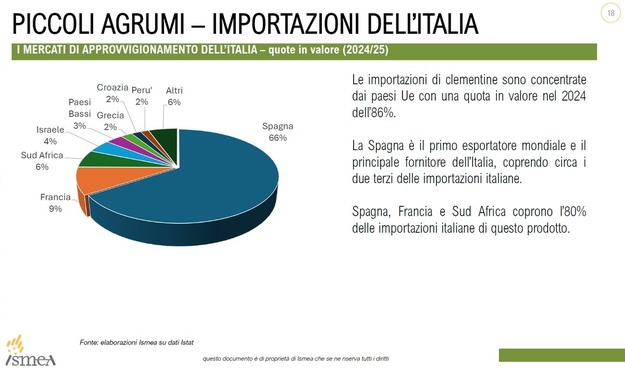

Regarding imports, there is a positive trend toward greater domestic self-sufficiency, as evidenced by the decrease in imported volumes. Imports are concentrated at the beginning (October–November) and end (February–March) of the season, as domestic production cannot fully meet demand during these periods. Spain is the main supplier, accounting for two-thirds of total imports. However, the recent trade surplus of €5.3 million demonstrates the supply chain's overall competitiveness.

© ISMEA

© ISMEA

Key strategies for future growth

Although the overall picture is positive, the Italian clementine industry still has considerable untapped potential. According to Schiano, this potential can be unlocked through coordinated efforts in four fundamental strategic areas. The first is varietal innovation to extend the growing season. "This is the key strategic priority on which the sector's ability to grow depends," he says. "Extending the commercial calendar from three to six months, from September to March, would drastically increase sales in domestic and foreign markets. To avoid falling behind, it is crucial to balance introducing new hybrids that the market demands with preserving traditional varieties."

"Innovation should extend beyond genetics to include all agronomic practices. Investments in research must focus on critical areas to address sustainability and market demands. These areas include water resource management, plant nutrition, and defense management, given the reduction of available molecules and market demand for lower residues," Schiano continues. "A two-level market development plan is also essential. We need to launch a targeted promotional campaign in the domestic market to highlight the many benefits of clementines. These include their low calorie count (40 calories per 100 grams), high vitamin content (C, A, and B), potassium, fiber, and the mood-boosting properties of their essential oil." This campaign should follow the model of US almond and walnut producers, who finance scientific studies to support marketing efforts. Abroad, efforts must concentrate on penetrating high-value, untapped markets with one priority target: the UK."

The final focus is equally important: the integrated promotion of both the product and the region. "The strength of the Calabrian clementine lies in its deep connection to its place of origin. This connection must be leveraged effectively. Why not use the Clementine di Calabria PGI as the cornerstone of regional marketing activities? Why not promote initiatives that encourage the marketing of clementines in tandem with other products from Calabria that have a protected designation of origin or protected geographical indication, forging a strong, collective regional brand? Why not use packaging as a direct communication tool? It can convey information about the product and the region. This will capture consumers' attention on the shelf."

© Maria Luigia Brusco | FreshPlaza.com

© Maria Luigia Brusco | FreshPlaza.com

Aggregation as an essential foundation for success

Schiano's analysis outlines an ambitious and clear growth path for the Italian clementine industry. However, none of the strategic objectives identified, ranging from varietal innovation and market penetration to agronomic research and territorial marketing, can be achieved without a fundamental prerequisite: aggregation.

"It is imperative that all operators in the supply chain collaborate. Whether through company mergers, the creation of business networks, or solid operational partnerships, overcoming fragmentation is necessary to achieve the critical mass required to compete on a global scale." The outlined objectives are medium-term and require consistent teamwork. Only through unified and coordinated action will the entire supply chain be able to reach its full potential and take advantage of the significant opportunities the market offers," Schiano concludes.