Between July and September 2025, Brazil's orange juice exports fell by 4.4% year-on-year, according to data from CitrusBR, the Brazilian industry association. The decline comes amid a slower harvest and subdued consumer demand in major markets.

Brazil remains the world's largest exporter of orange juice and the main supplier to Europe and the United States. However, exports to Europe dropped nearly 23% year-on-year during the quarter, driving the overall decline. In contrast, shipments of frozen concentrated orange juice (FCOJ) to the U.S. rose 17% year-on-year, while exports to China and Japan decreased by 34% and 69%, respectively.

© Mintec/Expana

© Mintec/Expana

According to CitrusBR executive director Ibiapaba Netto, the slower pace of harvesting has been a key factor. "As of mid-August, about 25% of the 2025/26 crop had been harvested, compared with 50% at the same time a year earlier," he said. The delay was caused by cooler weather, which slowed fruit ripening.

Consumer demand remains another challenge for the industry. High prices in 2024, combined with producers shifting to juice blends containing more water and less fruit, reduced consumption levels. Netto explained, "The general sentiment is that the high prices from the previous crop, combined with quality issues caused by weather conditions, influenced consumer choices, leading them to switch to other products."

He added that changing consumer preferences for higher-quality juice has further influenced harvest timing. "The market is more demanding in terms of quality, requiring properly matured fruit, and this affects the pace of harvesting and processing."

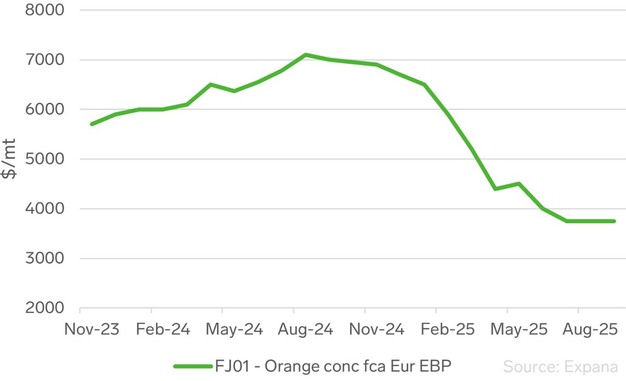

FCOJ prices began to decline sharply in August 2024 as demand weakened, continuing through the first half of 2025. Prices have since stabilised as the market awaits the outcome of the 2025/26 crop and contract settlements by major producers.

According to market data from Expana, the benchmark price for orange concentrate FCA Europe stood at US$3,750 per metric tonne in September, unchanged from the previous month. Sources told Expana that renewed consumer interest will depend largely on retail price levels, which could become more competitive in the months ahead.

Source: Mintec/Expana