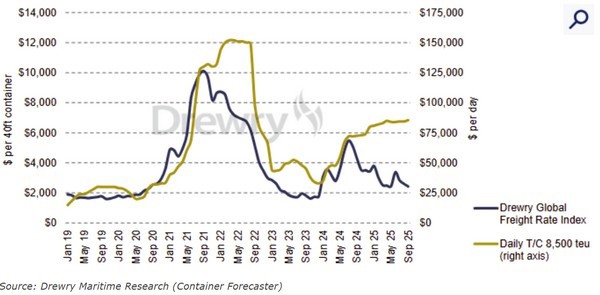

The global container shipping sector is experiencing a growing disconnect between freight and charter rates. According to Drewry, spot freight rates have fallen in recent months, but charter prices for containerships remain about 200% above 2019 levels. The firm expects the imbalance to persist into 2025 before a gradual correction begins.

Freight rates typically adjust quickly to market conditions, while charter rates respond more slowly because many vessels are fixed on multi-year contracts. However, this gap has widened beyond normal levels due to a combination of factors affecting vessel supply and operational behaviour.

A shortage of available charter tonnage is the main driver behind sustained high charter prices. Major carriers such as MSC and CMA CGM have expanded ownership of their fleets, absorbing much of the second-hand market and limiting availability for non-operating owners. Liner-controlled fleets now represent 64% of total capacity, compared with 54% in 2019, giving operators greater leverage in pricing.

Geopolitical disruptions have also tightened supply. Ongoing conflict and security risks in the Red Sea have forced many vessels to divert around the Cape of Good Hope, extending voyage times and reducing effective global capacity. This has increased short-term charter demand.

Carriers are also locking in long-term charters to maintain service reliability and protect against future market disruptions. Demand for modern, fuel-efficient tonnage remains particularly high, keeping charter rates elevated.

At the same time, new environmental regulations from the International Maritime Organization (IMO) and the European Union's Emissions Trading System (EU ETS) are influencing vessel selection. The limited availability of dual-fuel and energy-efficient ships has created a "green premium," further pushing up charter prices.

Despite current conditions, Drewry expects the market to eventually correct. The firm forecasts global freight rates to decline by around 16% in 2026, while charter rates may rise slightly across some vessel classes before easing later.

As new vessels enter service, cargo demand slows, and traffic through the Suez Canal returns to normal, capacity pressures are likely to ease. "At some point, the impetus to hire ships will unwind," Drewry said. "The charter market can't defy fundamentals forever."

Source: Container News