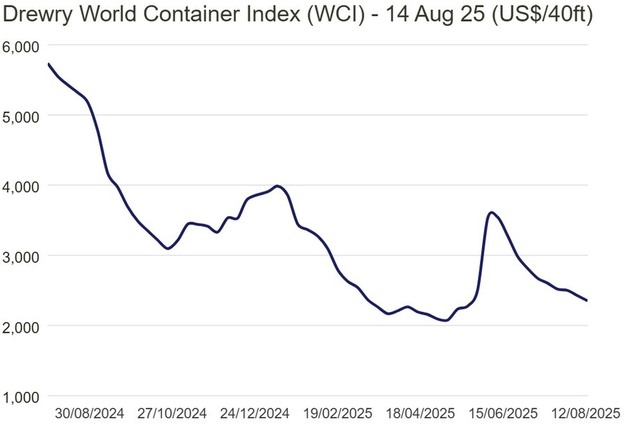

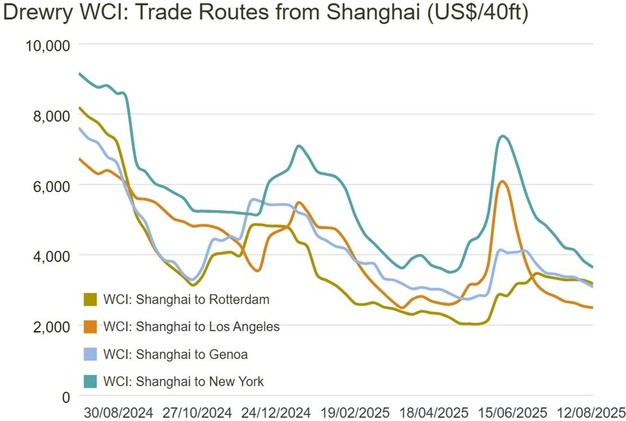

Drewry's World Container Index (WCI) has fallen for nine consecutive weeks and is showing signs of stabilisation after a volatile period. The instability began after US tariffs were announced in April, which pushed rates sharply higher from May through early June. This was followed by a steep decline until mid-July, after which the rate of decrease slowed considerably.

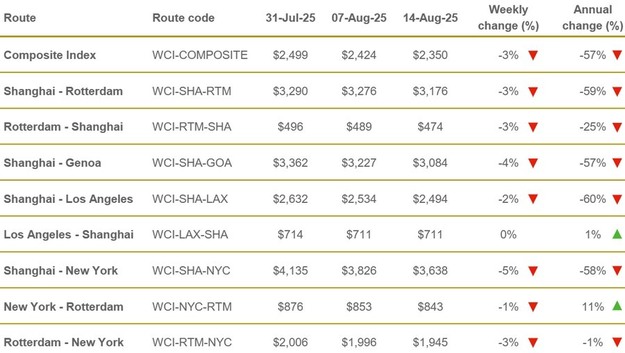

Transpacific spot rates dropped this week, with Shanghai–Los Angeles down 2% to US$2,494 per feu and Shanghai–New York down 5% to US$3,638 per feu. With the rush to ship cargo ahead of the tariff increase now over, Drewry expects spot rates to be less volatile in the coming week.

According to Drewry's Container Forecaster, the supply-demand balance is expected to weaken again in the second half of 2025, leading to further contraction in spot rates. The scale and timing of future rate movements will depend on potential new US tariffs under the Trump administration and on capacity changes linked to planned US penalties on Chinese ships, both of which remain uncertain.

© DREWRYFor more information:

© DREWRYFor more information:

Drewry

Tel: +44 (0)207 538 0191

Email: [email protected]

www.drewry.co.uk