According to Luis Miguel Vegas, general manager of Proarándanos, Peru, expects to export more than 400,000 tons of blueberries in the 2025/2026 season, 25% more than in the last season.

"The sector has been growing at an average rate of 30% per year since 2016. This season looks promising, with healthy plants and an abundant, high-quality harvest," he said during a webinar hosted by the consultancy Fluctuante.

The Peruvian industry has shown great resilience after extreme weather events. In the 2023 season, El Niño reduced export volumes by more than 40%. However, this also had an unexpected positive effect, as prices in some markets even doubled.

In the 2024 season, Peru largely recovered the lost volume. However, the peak harvest arrived later than usual because many growers postponed their pruning after El Niño. This shows that seasonality and volume concentration continue to be a structural problem that puts pressure on prices and logistics.

The new record volume brings challenges. Three consecutive weeks of more than 24 million kilos per week put a heavy burden on logistics, as the sector needs more trucks, refrigerated containers, personnel, and infrastructure, Vegas stated. "If we continue to grow without increasing the harvest period, the system will crash," he warned.

According to Vegas, spreading out the harvest is crucial to maintaining a competitive position. "Varietal replacement is essential. Traditional varieties like Ventura and Biloxi, the driving force behind growth for years, are now making way for stronger, more flexible varieties like Sekoya Pop and Mágica. These are more resistant to extreme weather and help distribute the yield over a longer period."

New varieties already account for around 60% of the acreage in Peru.

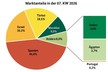

In terms of sales, the U.S. remains the most important market, receiving over 55% of exports. However, Proarándanos is also focused on China, which is expected to increase its share by 6 percentage points thanks to logistical improvements, including the use of the new port of Chancay, which reduces transit to Asia by 10 days.

Vegas added that there is a shift towards alternative ports, both at origin and destination, to reduce risks such as congestion at the Port of Callao or strikes at U.S. ports, such as Philadelphia.

One of the major risks of accelerated growth is the pressure on international prices. Despite its high quality, Peruvian blueberry needs more investment in international promotion to increase per capita consumption and maintain attractive prices, Vegas said.

"We are growing at 30% per year in volume, but consumption in markets like the United States is growing at less than 10%. We urgently need to promote consumption in new markets and strengthen our country brand," he warned.

Source: frutasdechile.cl