With a value of just over €100 million, hazelnuts are the crown jewel of Georgia's fruits and nuts exports. Last year, they brought in nearly four times as much foreign currency as mandarins, blueberries, or stone fruit. The vast majority—90% already shelled—heads to the European Union, which accounts for 62% of exports (source: Geostat). There, they're especially popular with chocolate manufacturers.

For a small country, Georgia is a major player on the global hazelnut stage. In 2023, it produced 36,900 tons, making it the sixth-largest producer worldwide. Turkey remains the undisputed leader with 650,000 tons, followed by Italy (102,700 tons) and the U.S. (85,500 tons). Azerbaijan (75,400 tons) and Chile (65,600 tons) round out the top five (source: Faostat). Then comes Georgia. Notably, around 66% of the world's hazelnuts are grown in the mild, humid climates along the Black Sea and Caspian coasts.

© FreshPlaza

© FreshPlaza

Jener Belkania and David Ekhvaia run Geo Nuts, a key contributor to Georgia's hazelnut industry

One of the key contributors to Georgia's hazelnut industry is Geo-Nuts, a growing, processing, and export company based just 30 kilometers from Anaklia, on the Black Sea coast. Founded in 2000 to supply the local market, Geo-Nuts took a turn toward international expansion in 2006. "We started exporting to Russia and the EU," says David Ekhvaia, who runs the company alongside Jener Belkania. "Today, 90% of our exports go to Europe, mostly shelled nuts."

Geo-Nuts is one of about 50 hazelnut exporters in Georgia and was among the first to obtain BRC++ certification for its processing facilities. The investment paid off: in 2023, the company exported 1,000 of the 13,000 tons of shelled nuts Georgia shipped to the EU (source: Faostat). Half of those went to Germany, the other half to Italy.

© Geo Nuts

© Geo Nuts

Geo Nuts is based in Zugdidi, just 30 kilometers from the Black Sea coast

Own orchards and local partnerships

Since 2015, Geo-Nuts has been cultivating hazelnuts on its own 110-hectare orchard, certified under GlobalGAP. "We also buy about 3,000 tons annually from around 800 small farmers and 150 mid-sized growers," David adds. "We apply strict quality standards. With the smaller farms, we end up accepting only about half of what's offered. The rest just doesn't meet our criteria." Samegrelo, the region where Geo-Nuts is based, has a long-standing tradition of hazelnut farming. "Almost every household has at least a small orchard. It's in the DNA of this area."

Italian variety vs. local competition

Geo-Nuts grows 70% of the Italian Giffoni variety and 30% of the local Anakliuri. "We started with Giffoni 20 years ago. It's ten times more expensive to plant, but yields twice as much—around four tons per hectare, compared to two for Anakliuri," David explains.

Giffoni nuts are also rounder and have a higher kernel-to-shell ratio—50% versus 40%. "But don't underestimate the local variety. It's high quality too. The problem is, that it's not easy to plant on a commercial scale. There simply aren't any nurseries for it." Still, Giffoni isn't without its risks. "About ten years ago, we saw the first signs of disease in Giffoni trees. Anakliuri is much more resistant—especially in our climate."

The brown marmorated stink bug

An even greater threat than disease came in the form of the brown marmorated stink bug (Halyomorpha halys), an invasive pest that appeared around 2015 from Asia. "Yields plummeted, quality suffered, and prices collapsed. It was a disaster," David recalls. Many smallholders couldn't, or wouldn't, afford pesticides. "Some refused to use them because they keep bees. That's understandable, but it contributed to the spread."

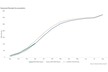

Eventually, government subsidies helped bring the outbreak under control, but vigilance is still essential. The impact is clear in harvest figures from Geostat: compared to the 2010–2014 average of 31,600 tons per year, yields between 2015–2019 dropped to 25,400 tons annually, with a low of just 17,000 tons in 2018. But the tide has turned—2024 hit a record 43,600 tons.

Labor-intensive work

Hazelnut farming is highly labor-intensive, especially during harvest season from August 1 to 25. Geo-Nuts employs 20 full-time staff but needs 300 seasonal workers during the harvest. "In the first round, we collect about 80% of the nuts that fall naturally. In the second, we use tree shakers to gather the rest." Labor shortages are a serious concern in Georgia. "There just aren't enough workers. Especially young people are leaving. As an industry, we need to address that challenge."

From drying to briquettes

After harvest, the hazelnuts are dried in-house—up to 100 tons every two days—and undergo strict quality control. "We test for aflatoxins, a naturally occurring but toxic substance that can appear in nuts. Georgian nuts have three times less aflatoxin than those from Azerbaijan," David says proudly. Government regulations require aflatoxin testing, but Geo-Nuts also screens for pesticide residues. After quality checks, the nuts are shelled at a rate of 30 tons per day. "The leftover shells are sold locally and turned into briquettes. Nothing goes to waste."

© FreshPlaza

© FreshPlaza

Hazelnut roasting machine from Turkish machine manufacturer Ceselsan

From size 11 to 15+

Geo-Nuts sells its hazelnuts in various sizes: 11, 13, and 15+. "About 60% of the Georgian crop is size 13," David says. "In Turkey, sizes 11 and 13 dominate. For fresh retail, bigger is better, but chocolate makers don't really care."

© FreshPlaza

© FreshPlaza

The shelled nuts are packed in 40-kilo bags and shipped to chocolate suppliers

Only 10% of sales go to the fresh market; the remaining 90% is destined for processing. "Our shelled nuts are packed in 40-kilo bags and shipped to chocolate suppliers. About 20% of the volume is roasted and packed in 20-kilo boxes." The fresh market may be small but holds promise. "Retailers in Europe haven't really tapped into it yet. We'd love to help develop that segment." Geo-Nuts also offers chopped hazelnuts and hazelnut flour.

© FreshPlaza

© FreshPlaza

About 20% of the volume is roasted and packed in 20-kilo boxes

Diversification and big dreams

Looking ahead, Geo-Nuts is already diversifying. They've recently planted 15 hectares of blueberries. "You never know what climate change or market shifts might bring," says David. "Diversification is just smart." But his biggest dream? A chocolate factory of their own. "From tree to bar—that would be amazing."

For more information:

David Ekhavia (co-director)

Jener Belkania (founder en co-director)

Geo-Nuts

Vil. Ingiri

2100 Zugdidi (Georgia)

Tel.: +995 415 222 371

[email protected]

www.geonuts.ge

Published before in this series:

1. Introduction 1: Coming weeks, Georgia Special

2. Introduction 2: Export flows of Georgian fruit

3. Photo report: Wholesale market in Tbilisi

4. Barrylux: Georgia's first year-round hydroponic strawberry producer uses geothermal energy

5. Geo Nushi: Almond grower focuses on organic for the EU market

6. Walnuts.ge: Georgia to distinguish itself with quality walnuts

7. Colibri: Favorable export window for developing blueberry sector

8. GFA: "Confidence is growing among fruit growers and exporters"

9. Georgian Walnut Enterprise: Georgia aims to meet the growing global demand for walnuts

10. AgroCom: Apple production: high yields, rising exports

11. Bachuki Ruadze: Wild price swings for mulberries

12. GeoOrganics: "90% of our blueberry harvest is destined for export"

13. SpaceFarms: Modular vertical farms for restaurants and private clients in Tbilisi and beyond

14. Alverdi: Table grape production still in its infancy