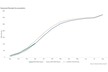

The Australian almond industry has experienced strong and sustained growth over the past two decades, a trend that is expected to continue. Australia is now the world's second-largest producer and exporter of almonds, though production volumes remain significantly lower than those of the United States.

Almond production for marketing year (MY) 2025/26 (January to December 2026) is forecast to reach a record 175,000 metric tons (MT), up from an estimated 145,000 MT in MY 2024/25. The lower output in the previous year was primarily attributed to extreme heat across key growing regions and cost-reduction strategies adopted by corporate producers in anticipation of soft market prices. The projected rebound in MY 2025/26 reflects a recovery from these conditions, supported by the continued expansion of bearing almond acreage and improved market conditions encouraging growers to maximize yields.

On June 12, 2025, the United States and China reached an agreement to reduce the retaliatory tariff on U.S. almonds entering China from 125 per cent to 10 per cent. However, this reduction comes on top of other existing tariffs. As a result, the overall tariff on U.S. almonds exported to China has shifted from 35 per cent (before the retaliatory escalation in April–May 2025) to 45 per cent going forward. This has further eroded the competitiveness of U.S. almonds in the Chinese market, which traditionally sources about half of its almond imports from the United States and the other half from Australia.

While this situation improves the relative competitiveness of Australian almonds in China, thanks to a zero-tariff rate and a relatively weak Australian dollar, exports are unlikely to rise dramatically. Australia's harvest is counter-seasonal to that of the United States, and although conditions are favourable, Australia's overall production remains limited and cannot expand rapidly to fill gaps in global supply.

Domestic almond consumption in Australia accounts for about 20 per cent of total production and grows in line with population trends. Consequently, most of the production increases are destined for export markets. For MY 2025/26, Australian almond exports are forecast to reach a record 143,000 MT. China has emerged as a key growth market, accounting for up to half of Australia's total almond exports in recent years.

To view the full report, click here.

For more information:

For more information:

USDA

Tel: +1 (202) 720-2791

Email: [email protected]

www.usda.gov