Key statistics from the booklet include:

- 2016 Crop production was 82,333 tonnes based on kernel weight

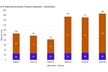

- 4,904 hectares planted in 2016, an increase of 15.8%

- Current orchard area is 35,886 hectares with over 10 million trees

- Almond export value for 2016 marketing year was $434 million

- 2017 crop forecast is 82,335 tonnes

With demand growing rapidly the industry entered a period of high growth in orchard area with 4,904 hectares planted in the Murray Valley, an increase of 15.8%. The number of trees planted in Australia passed 10 million covering an area of 35,886 hectares.

Nursery orders indicate a similar increase in the area planted will be repeated during the 2017 winter, further increasing the industry’s productive capacity and its ability to meet growing consumer demand in future as trees commence bearing and grow to full yielding.

Figures released today by the Almond Board of Australia (ABA) show production levels were steady with little variance across the 2015, 2016 and 2017 crops. Australia remains the world’s second largest producer with 8% of global supply but well behind the Californian almond industry that grows 80% of the world crop.

India remained Australia’s largest export market with a preference for in-shell product that they mostly crack by hand to produce near perfect kernel that is popular for gift giving as well as every day consumption.

European countries received 43% of Australian almond exports, and Asian countries, excluding India, received approximately 13%. Dynamic economies with large populations of increasingly prosperous and health conscious consumers mean that these markets will continue to import more almonds each year going forward.

Almond Board of Australia CEO, Ross Skinner, believes the success in developing the domestic and export markets during 2016/17 has been realised due to the efforts of the industry marketers and their preparedness to work collaboratively in identifying ways to develop markets and fund promotional activities via a voluntary marketing levy managed by the ABA.

“The Australian almond industry invests over $2 million annually building demand in established and emerging markets by undertaking activities developed and guided by representatives of the five major marketing companies.”

“During the past year, the industry marketers and our Market Development Manager have been present at the major food trade events in Europe and throughout Asia to develop trade contacts from the many buyers who visit the Australian almond industry stand and to also meet with established customers”.

“In recent years, Free Trade Agreements have assisted sales in Korea, Japan and China and a lot of effort has gone into market research into promising markets such as Indonesia”.

“Although nearly three tonnes are exported for every tonne sold domestically there is a clear focus on ensuring the positive health benefits message of eating almonds reaches Australians as this is a key driver of why almonds were consumed in nearly half the households in Australia in the past year” Mr Skinner stated.

With the rapid growth of the industry over the past decade set to continue on the back of the renewed surge in plantings the Australian almond industry expects production will grow to in excess of 130,000 tonnes by 2025.

“Product differentiation is the key for Australian almonds. Major competitors such as the USA and Spain have significant production advantages with cheap labour and lower input costs, with which the average Australian grower is unable to complete. In order to command a premium price over the significant volumes being produced by these countries, the Australian grower must supply almonds of the highest quality.”

Consumer demand for almonds continues to increase strongly, both domestically and globally, limited only by supply. In the past decade, Australian consumption has risen by more than 85%, and global demand has also doubled. This trend is expected to continue as living standards in developing countries rise, the range of new products using almonds expands rapidly and consumers grow increasingly aware of the health benefits of eating a small handful of almonds several times per week.

The full booklet can be read at australianalmonds.us8.list-manage.com.

For further information contact:

Ross Skinner

Tel: +61 0448 049 202