In the last few weeks, Chilean cherries arrived on the Chinese market in large volumes. Growers and traders are working hard to bring their best quality fruit into the Chinese market. At the moment, market performance is good with a solid price. The biggest problem traders face is the slow movement at the arrival ports. There are thousands of containers waiting to be unloaded.

Julio Ruiz-Tagle is the Asia & Americas Manager at the quality service provider D-Quality Survey. He shared with us the production and market status of the current cherry season and his insight into the Chinese market.

“So far we have had good market movement with a fair price”

“The sea shipping containers are arriving in large quantities. Our team in China is very busy at the moment. In the past two weeks, our team in China checked nearly 300 containers from different exporters and with different varieties.”

This season, Chile will again export a record volume of cherries. “At the moment we've already delivered 4,000 containers of cherries. Between now and 27 January, we expect another 7,000 containers of cherries to arrive in the port of Hongkong.” Julio said.

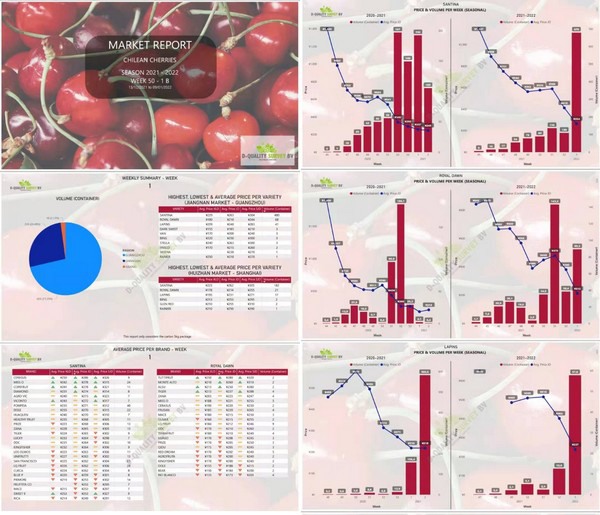

“The market has been moving normally so far, especially the air-freight cherries and the first batch of sea-freight cherries at the beginning of the season showed very good performance, with fast sales and solid prices around 300-350 RMB [47.28-55.17 USD] per box. Of course, when large volumes arrived, the market price started dropping at the end of December, but that was still in a normal range. At the moment the price of first grade Bing/Lapins varieties is around 250 RMB [39.40 USD] per box.”

Julio shared his expectations of how the market will lead in the next few weeks, “There will be more volumes arriving in the next 2 weeks. But with Chinese New Year coming soon, there is also a big demand in the market. Especially there will be more Kordia and Regina arriving. These varieties are dark in color, have a nice shape and excellent flavor. That is why they are liked best by Chinese consumers.” Julio said. “The weather is good in production areas. The Chilean government is still pumping up marketing projects in the meantime, and Chinese importers and buyers are still highly enthusiastic. I think if there are no unexpected issues, then this will be a very good season for Chilean cherries.”

“Quality is good; logistics is the biggest problem so far”

In the last two weeks, we checked for issues with declining product quality. Around 12% of the products showed general quality problems; of these cherries, 10% was stemless, 5% was soft, 1% showed signs of decay, and 16% had pitting problems.

Last year, many Chilean exporters faced package shortage problems. “This year packaging shortage is not a big issue anymore. Some exporters already started buying materials last year in June or July, and they are now using these materials.” Julio said, “package shortage was a problem for a long time, so people are already getting used to it, and they are now better prepared.”

At the moment, the biggest problem exporters and importers are facing is the slow arrival of containers. Port stocking is a real problem everywhere and some of the most affected ports are China’s main ones for fresh fruit importations. “Some of our customers’ containers stay in the port three to ten days after arrival. I don’t see this changing in the near future. For me, it’s fundamental to take this situation into consideration and add suitable technology that can allow the fruit to be kept for more days. It can be a valuable solution to overcome this problem.” Julio said.

“We provide both quality data and commercial reports to our customers”

As a quality inspection company, D-Quality Survey is very focused on fruit quality control, especially on the defects that affect the quality and the conditions of the arrivals. “Some other factors that we evaluate are shelf life, gas balances on ATM or CA bags, temperature chain, ventilation, and containers settings too. This is of course very useful for any related claim, but also gives the seller-buyer relationship a good support for their trust as we are a qualified and reliable third-party company. In addition, and in my opinion much more important, we generate quality data which nowadays is very useful so our customers can compare between their growers, varieties, dates, and the data also allows them to take strategic decisions and keep improving season by season. Particularly in China, we also give commercial support to all our customers through our sales monitoring protocols.” Julio introduced.

Besides quality inspection, D-Quality Survey acts as an official survey company, by making evaluations and reports for their customers. “We have a mixed Chilean and local staff doing this in Shanghai Huizhan Market and Guangzhou Jiangnan Market, the two main import wholesale markets in China. We provide up-to-date quality statistics and track how many containers were opened or have been sold each day in the market. Also every day we take videos in the market, and point out what market issues the client is facing. Our customers can access these reports with their APP or on our website.” Julio said, “These commercial reports provide much up-to-date info giving the whole quality-commercial context for each arrival needed by our customers, and they can use this info for making their sales decisions.”

“Now we have a team of 10 people in China. They are in the wholesale market every day, so that we are able to chat with our customers at any time and are able to answer their market related questions at any time. In this way, we want to help our customers deal with misunderstandings and increase the trust between them.”

For more information:

D-Quality Survey

Julio Ruiz-Tagle (Asia & Americas Manager)

E-mail: j.ruiztagle@dqualitysurvey.asia

Phone: +56992500021 (Chile Phone) / +8613229312404 (China Phone/Whatsapp/Wechat)

Website: https://www.dqualitysurvey.com/