The COVID-19 pandemic has disrupted the way fresh produce is traded. More noticeable has been the disruption to shipping, with dramatic rises in shipping costs, shipping container shortages and worldwide delays in deliveries. This is especially felt in fresh produce trade, where needs dictate more expensive reefer containers and short shipping times to avoid spoilage. Smaller exporters are bearing the brunt of this, unable to “pull rank” with shipping companies to secure shipping space and unable to resist cost increases to the same degree as larger exporters.

Importers too are facing disruptions. Unpredictable and recurring lockdowns can instantly dry up wholesale demand channels while containers full of product are already en route on the water. This can force Importers to lower prices in order to clear their product and avoid spoilage. Unfortunately, the opposite problem has also been faced due to shipping delays. Inability to meet their customers’ needs reliably has damaged importers relationships with their customers and has caused importers untold commercial harm. Again, it is the smaller importers that feel this most, with customers switching to larger importers who can guarantee supply and who do not face the same disruptions due to their buying power.

But the COVID-19 changes are not all bad news. Across the entire supply chain, we have seen industry-wide innovation to overcome the pandemic disruptions. Digital solutions for export documentation and tracing product provenance are being embraced at an accelerating rate, as are automated sorting, grading and packing equipment which is not as susceptible to interruptions in the available workforce. Importers are also using this opportunity to get closer to exporters, in order to reduce points of failure in their supply chain. Increasingly, digital marketplaces are enabling importers to trade directly with exporters, without the need for traders, agents and other intermediaries.

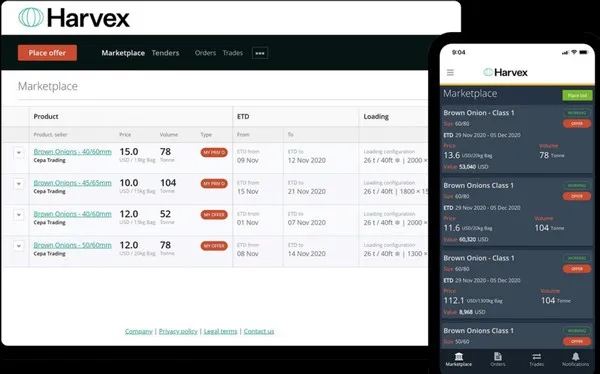

Harvex is one such platform, being born out of Balle Bros’ (New Zealand) desire to digitise their export of onions to improve the productivity of their export function. Harvex was spun out as an independent company in 2020 and has since grown to facilitate trade from sellers across New Zealand, Australia, Egypt, India, Netherlands and Spain. Harvex’s buyers span all of South-East Asia, where Harvex has a wide in-market presence through its network of on-the-ground Business Development Managers. Over 8000 Metric Tonnes of onions have been traded on Harvex in 2021 so far, and this shows no sign of slowing down now that the Dutch main-crop season is upon us, explained Harvex’s Head of Operations, Tom Hooper.

“We’ve taken a deliberate approach to building up trade on Harvex very gradually. We want our buyers and exporters to have a great experience and to trade confidently knowing that every seller and buyer has been referred and vetted in-depth to build an environment of trust on the platform. This is really paying off and we are opening doors for both buyers and sellers to access product and trading partners that they cannot through their traditional approach alone.”

Harvex conducted a study into its marketplace participants to understand what was most important to them when choosing to trade via Harvex rather than through their existing channels. An except of some of the common responses below:

- Sellers are motivated by the opportunity to access a trusted pool of buyers to expand their customer base

- Some sellers simply use Harvex as a complementary channel to sell spot in addition to contract selling

- Some smaller sellers are able to use Harvex to access new markets, with Harvex supporting them to navigate the required certification, quota system and documentation

- Many sellers chose to trade with existing buyers via the platform because of the ease of managing a large number of trades

- Buyers are motivated by being able to go direct to sellers for a great price

- Buyers can access sellers who they previously may not have been able to access. Often these were large sellers, who were therefore able to secure shipping space

- Buyers can get a transparent view of market prices with no hidden taxes or fees

As is being proven, Harvex especially caters to the needs of small players. Smaller exporters are supported in their export function to be able to tap into new markets and get the kind of on-the-ground presence that would otherwise be beyond their scale. Similarly, smaller buyers are able to prove themselves as trustworthy buyers and therefore get access to major reputable exporters for the first time. Many market participants were able to lean on Harvex to get them through the shipping delays and disruptions caused by the pandemic, while at the same time achieving leaner and more efficient trading.

With the end to the pandemic still not clearly in sight, disruptions and complications continue to loom on the horizon. We can take some comfort in the knowledge that these challenges are bringing about real innovation, resulting in a shift in the way in which fresh produce is traded world wide – a shift which we can expect to long outlast the temporary adversity we presently face.

Harvex is now accepting applications from South East Asian buyers and reputable global exporters of onions.

For more information:

Harvex

Email: info@harvex.co

www.harvex.co