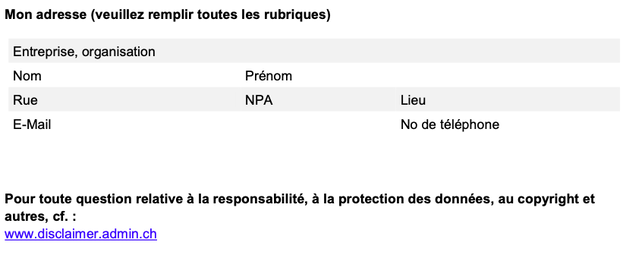

Apples have always been the most popular fruit in Switzerland. The consumption of table apples stood at 14.66 kg per person between 2000 and 2002, and at 13.9 kg in 2020. They are therefore ahead of bananas and far ahead of any other fruits grown in the country. Apples remain attractive, although we are seeing the emergence of new preferences when it comes to the different varieties. While the Golden Delicious was by far the most widely cultivated in 2002, the Gala has been the one on top in 2020.

The area devoted to apple cultivation has been reduced over the past two decades, from 4,471 hectares in 2002 to 3,671 hectares in 2020, based on currently available figures; however, some varieties have resisted and actually even gained ground.

Areas of the ten favorite varieties

The diagram below shows the development, in terms of average acreage, of the ten most produced varieties in Switzerland over the last five years. The Gala, which had 549 hectares devoted to it in 2002, has grown significantly and reached 876 hectares in 2020 (+60%). In contrast, the Golden Delicious has declined considerably (-68%), from 1,144 to 361 hectares. Next in the ranking comes the Braeburn (323 ha), which took the third place from the Jonagold.

The Braeburn and the Topaz have held it up well, unlike many others that have been declining for a long time, such as the Jonagold, Boskoop, Gravenstein, Maigold, Idared or Cloche. Other varieties have escaped this falling trend, namely the Scifresh, Milwa and Cripps Pink, which were actually almost irrelevant in 2002. Note the extraordinary growth experienced by the Rewena, which has gone from 5.5 hectares in 2019 to 94.9 hectares in 2020. The list of varieties and cultivated areas is published on OFAG's website: Statistics of fruit production.

Reasons for the interest in new varieties

The decision to grow one variety over another depends on many factors, such as the appearance of new cultivars or the changing demands. Another factor is the fact that club apple varieties promise higher returns to growers and traders (see Fruit and Vegetable Market Bulletin, October / November 2019). The production and marketing of these varieties is reserved for members of the "club"; that is to say, to approved producers and traders. They may, provided they meet certain quality standards, sell apples of the varieties Scifresh, Milwa and Cripps Pink under the registered trademarks Jazz®, Diwa® and Pink Lady® at a premium price.

The most expensive: club varieties and the Topaz

The second chart shows the average retail price of various varieties between 2007-2009 and 2017-2020 (up to October 2020). Apparently, already established varieties, like the Gala, Braeburn, Boskoop and Gravenstein, remained in the middle part of the price range during both periods, at around 3.50 fr / kg. The Golden Delicious stood slightly below (3.20 fr./kg), like the Jonagold ten years ago (3.23 fr./kg). Both of these varieties have largely lost ground over the past decade, and the price of the Jonagold has fallen to 2.20 fr./kg.

In the higher price category, we find the Topaz, much appreciated in the organic format, as well as the varieties Scifresh / Jazz®, Milwa / Diwa® and Cripps Pink / Pink Lady®. Note that the sales of some varieties outside their club denomination represent only a tiny proportion of their sales under the club denomination. This is the case of the varieties Scifresh / Jazz® (0.3%) and Cripps Pink / Pink Lady® (3.4%). As for the Milwa variety, significant sales were only recorded under the Diwa® brand.

The sharp rise in the price of the Topaz can be explained by the growing interest in its organic version over the past ten years. Thus, between 2007 and 2010, the organic Topaz apple production represented between 36 and 44% of the total; a share that has increased to between 65 and 90% between 2017 and 2020. As a result, most of the Topaz apples sold in recent years by retailers have been organically grown. This variety has shown potential to generate higher returns, even though the cultivated area has not increased and despite the higher production costs of the organic.

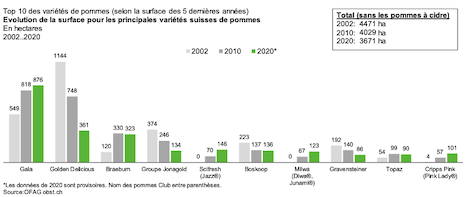

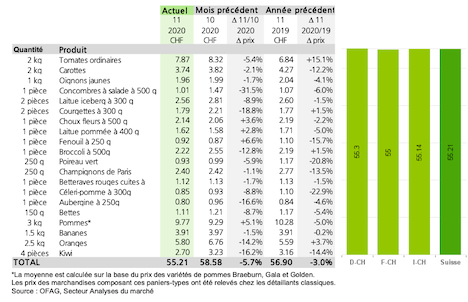

Periodic regional comparison of a standard basket of conventionally grown vegetables and fruits (consumer prices)

Starting in July, the standard fruit and vegetable basket cost less each month than the average of the previous four years. September was marked by the end of the Swiss production, as well as by the arrival of cheaper foreign goods at retailers. This is the main reason why the price of the standard basket has fallen since September. The average Swiss price has been set at CHF 55.21 per basket. The differences between the language regions in December were minimal, since in German-speaking Switzerland (the most expensive region) the basket cost just 30 cents more than in French-speaking Switzerland (the cheapest region).

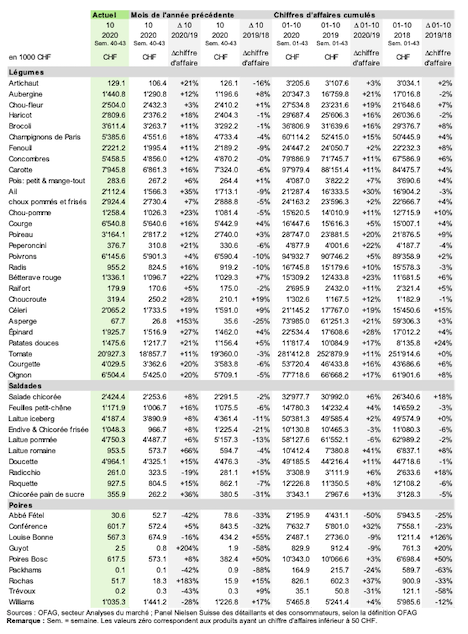

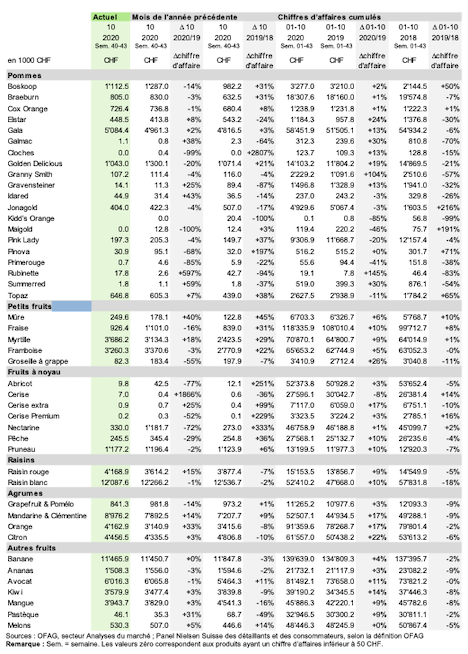

Turnover from household purchases for fruit and vegetables in Switzerland, organic and conventional cultivation (in 1000 CHF)

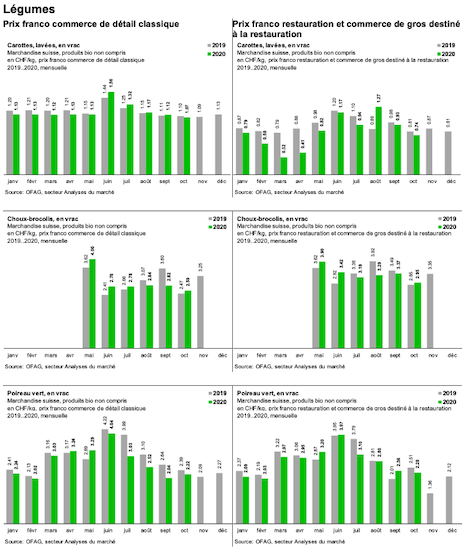

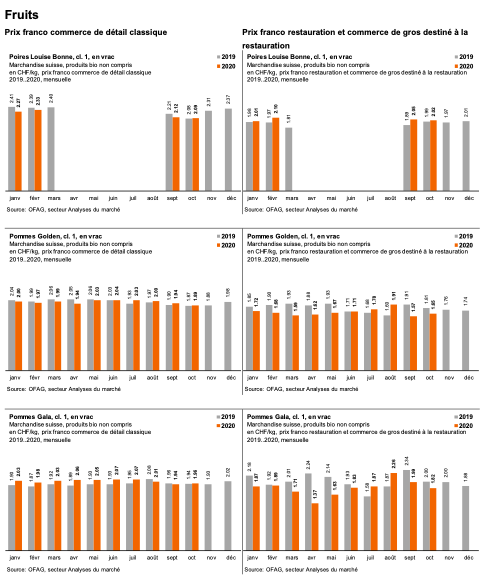

3 Wholesale prices of domestic goods

The price trends for some fruits and vegetables are shown below. The prices were collected by packing and handling companies (1st commercial level). Two channels were surveyed 1) traditional retail trade (i.e. without discounters) and 2) catering and wholesale trade intended for catering. These are compared in the two columns below.

Important information: Regarding the prices at the catering and the wholesale intended for catering, especially between March and May, but also in the summer, it appears that sales have been higher than usual in other channels because of COVID-19. For example, according to experts, retirement homes make up a larger share of the customer base than before the crisis.

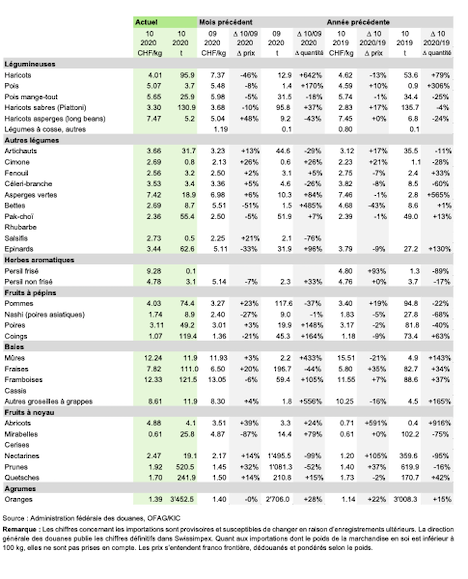

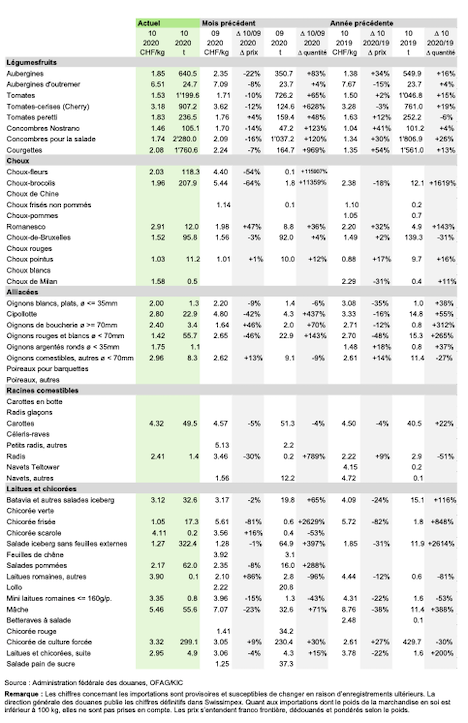

4 Import price (CHF / kg) and quantities imported (t):

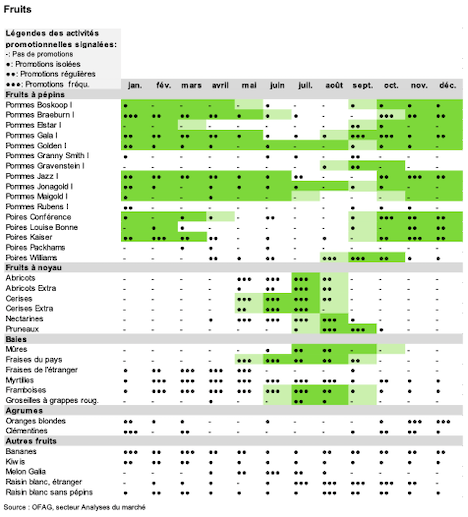

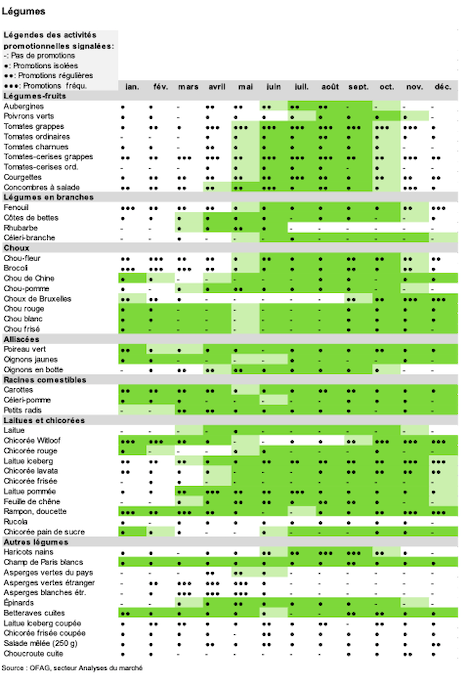

5 Swiss seasonal fruit and vegetable sales and promotions

The seasonal table for Swiss fruit and vegetables shows the months in which these products arrive freshly harvested on the market or are taken from storage. The months with Swiss fruit and vegetables are colored green; the pre-season or post-season months, known as the transition months, are shown in light green. For example, the right period for Boskoop apple sales is October to April. September and May are transition months. The Boskoop apple season therefore lasts from September to May.

The dots indicate the months in which fruits and vegetables are sold at promotional prices in the retail trade. Frequent promotions are indicated by three dots, an increase in the number of promotions by two dots, and occasional promotions by a single dot, while infrequent promotions are indicated by a dash. This table is based on empirical data collected over the years 2014 to 2017.

6 Methods

Fruit and vegetable basket: The choice of the 20 components of the fruit and vegetable basket is based on their importance in terms of consumption in Switzerland.

Average household of 3-4 people for one month.

Prices are retail prices (excluding discounters). When available, prices are those of products of Swiss origin; otherwise, they are those of the corresponding imported products. Prices are weighted according to market share and region.

Wholesale prices: Packing and handling companies (traders, market gardening farms or market gardening platforms, 1st trade level) report the quantities processed each month (excluding weight of the packaging) and the turnover (excluding value added tax and including door-to-door transport costs) for domestic goods from conventional cultivation. These figures are used to calculate the actual prices of Swiss fruit and vegetables. No prices are given if there is not enough data available.

Regions:

Three regions are taken into account for the regional price assessment:

-

D-CH: German-speaking Switzerland

-

F-CH: French-speaking Switzerland

-

I-CH: Italian-speaking Switzerland

The distribution between language regions is carried out at the district level based on data from the Federal Statistical Office. The exact composition of the language regions can be consulted at the OFAG website, Market Analysis section: https: //www.blw.admin.ch/blw/en/home/markt/marktbeobachtung/erlaeuterungen.html

Season: Actual economic period, according to the provisions for fruit and vegetable imports: http://www.swisscofel.ch/wAssets/docs/news/Leitfaden_Violett_Importregelung.pdf

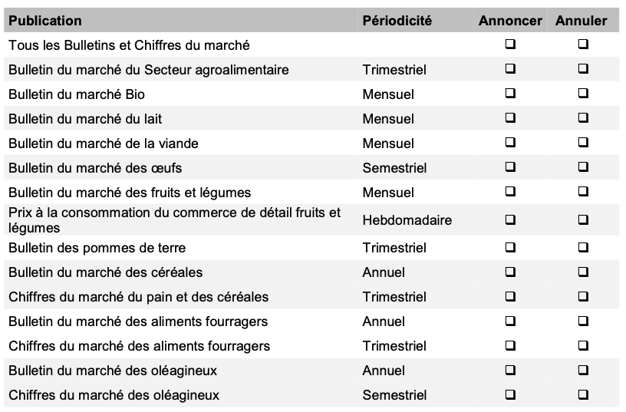

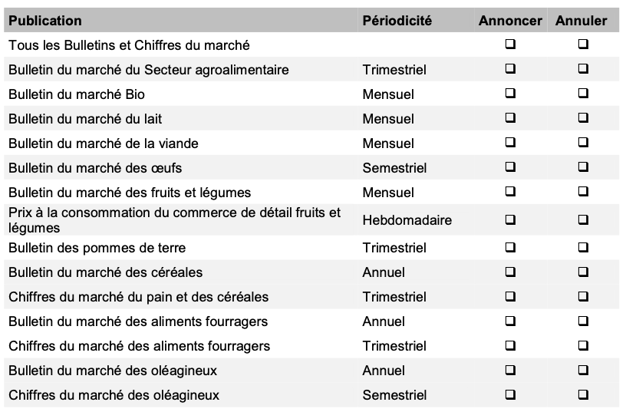

7 Subscription order form

Market Analysis publications are provided free of charge. They can be downloaded from www.observationdumarche.admin.ch under Market Watch. If you wish, we can also send you the newsletter by e-mail. Orders can be placed electronically at www.blw.admin.ch or in writing using the coupon below. Please complete it and return it to us by post (FOAG, Market Analysis Division, Schwarzenburgstrasse 165, 3003 Bern) or by fax (+41 58 462 20 90).