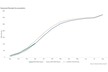

The Almond Board of California released its January position report, updating U.S. almond supply and demand through the 2025 to 2026 crop year. January shipments totaled 206.1 million pounds, down 9.8 per cent from 228.6 million pounds in January 2025 and below pre-report trade expectations of 230 million pounds.

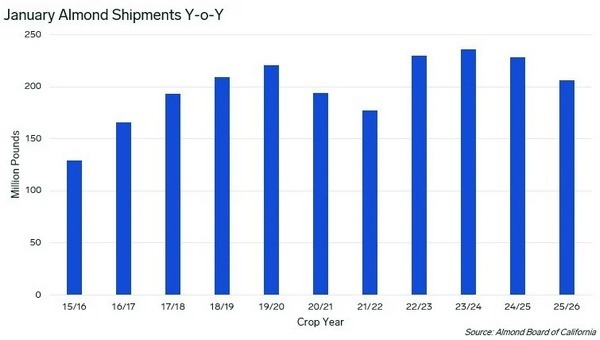

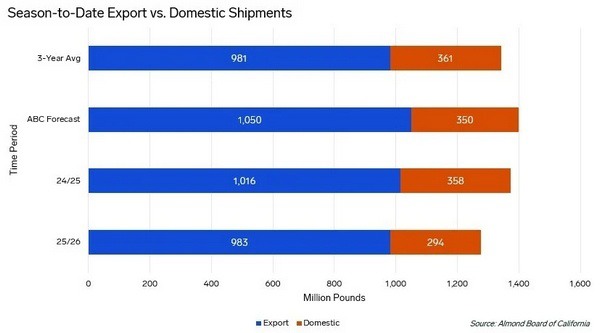

Season to date from August through January, total shipments reached 1,276.6 million pounds, 7.1 per cent behind last year and below the three-year average pace. January domestic shipments totaled 51.0 million pounds, down 17.4 per cent year on year. Export shipments reached 155.1 million pounds, down 7.2 per cent year on year. Exports represent 77 per cent of total season-to-date shipments, above the three-year average of 74 per cent, while domestic shipments are down 17.9 per cent year on year.

© Mintec/Expana

© Mintec/Expana

Key destinations show mixed performance. India shipped 39 million pounds in January, bringing its year-to-date total to 171.8 million pounds, down 12 per cent. Europe received 48.4 million pounds in January for a season total of 309.8 million pounds, down 3 per cent. The Middle East recorded 29.2 million pounds in January, with 205 million pounds season to date, up 4 per cent. China and Hong Kong shipped 3.4 million pounds in January, totaling 16.8 million pounds for the season, down 59 per cent.

Total commitments stand at 588 million pounds season to date, up 2.9 per cent year on year. New sales reached 298 million pounds in January, up 24.8 per cent from a year earlier and 51.6 per cent above December levels.

© Mintec/Expana

© Mintec/Expana

Crop receipts total 2,626.7 million pounds in kernel weight through January, down 1.4 per cent year on year. January receipts were 114.2 million pounds, up 29.2 per cent compared to the prior year. Approximately 98 per cent of the crop is typically received by the end of January. Market participants are using an estimated normalized crop size of 2.7 billion pounds for balance sheet analysis.

Sell-side participants cite logistics timing and vessel delays as factors behind January shipment levels and view higher sales and commitments as evidence of buyer engagement at recent price levels. Buy-side sources focus on the 7.1 per cent shipment deficit and stress the need for accelerated movement to manage carryover. Both sides indicate that pricing stability will be central to sustaining demand through the remainder of the season.

Source: Mintec/Expana