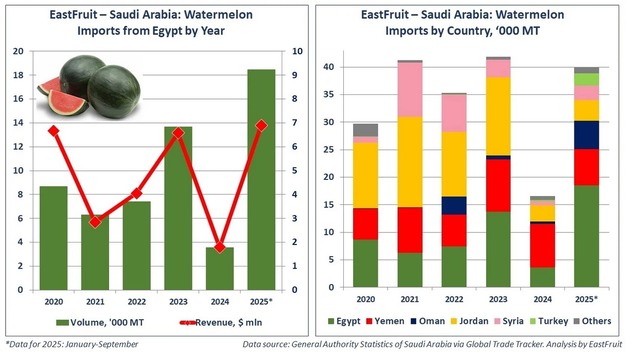

In 2025, Egypt expanded its watermelon exports to Saudi Arabia and recorded its highest shipment volume to date, according to EastFruit. In the first nine months of the year, Saudi Arabia imported 18,500 tons of Egyptian watermelons with a total value of US$6.9 million. This volume was five times higher than in the previous year and exceeded the earlier record set in 2023 by 35%.

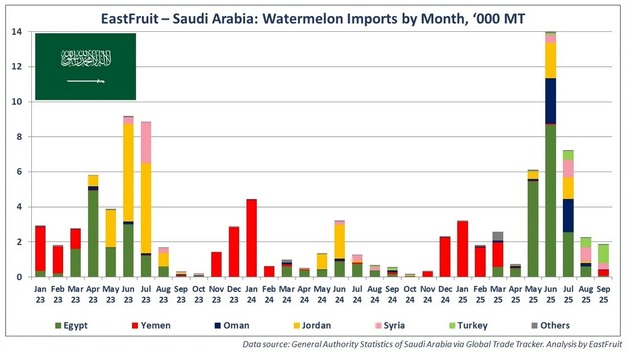

Saudi Arabia remained the main destination for Egyptian watermelons, accounting for close to 70% of total exports during the reporting period. Egypt's export season runs from March to September, with shipments concentrated between May and July. In June 2025 alone, exports reached 8,700 tons, which was 2.5 times higher than the total volume shipped during the entire previous year.

© EastFruit

© EastFruit

Despite being one of the largest watermelon producers in the Middle East and approaching self-sufficiency, Saudi Arabia continues to import watermelons to manage seasonal supply patterns and access specific varieties. Import demand typically peaks between May and July, which overlaps with the domestic harvest period. Consumption during this period is high, particularly when daytime temperatures regularly exceed 45°C, increasing demand for high-water-content fruit.

Logistical considerations also influence import flows. Saudi Arabia's geographic scale means that sourcing watermelons from neighbouring countries can be faster and more cost-effective for northern regions near Jordan and western regions with maritime access across the Red Sea, compared with transporting fruit from central production areas.

© EastFruit

© EastFruit

Until 2024, Jordan was the main external supplier of watermelons to Saudi Arabia, with additional volumes coming from Egypt, Syria, and Yemen, mainly during the winter months. In 2024, domestic production reached a level that allowed Saudi Arabia to cover about 99% of its needs, sharply reducing imports except for limited winter supplies from Yemen.

Market conditions changed again in 2025. While domestic production levels remained stable, population growth of more than 1.5 million people increased overall consumption. At the same time, Jordan's export capacity declined due to water shortages. These developments opened space for alternative suppliers, allowing Egypt to regain market share in Saudi Arabia and reach record export volumes during the 2025 season.

Source: EastFruit