It's been a tough few years economically for California almond growers. However there's some modest optimism ahead according to Rabobank's Five-year California Almond Outlook report.

In almond production, the report notes that over the past four years, including the 2025 crop year, yields have averaged well below the previous 10 years. "The age of bearing acres and the current price recovery phase suggest that yield recovery is inevitable," notes the report.

What will yields look like?

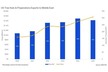

Those yields are expected to grow from current levels in the coming years with production potential likely to peak in 2026 or 2027. That would be its highest level in five years, but still be at or below 3 billion lbs. "After that, production is expected to drop off due to a decline in bearing acreage," says Roland Fumasi, head of RaboResearch, food & agribusiness -North America, who authored the report.

© Rabobank/Almond Board of CaliforniaReplanting on almonds has slowed down due to almond economics, says Fumasi.

© Rabobank/Almond Board of CaliforniaReplanting on almonds has slowed down due to almond economics, says Fumasi.

Following bearing acreage likely peaking this year, any further increase in total bearing acres will be marginal, unless acreage is kept in production past its 23rd year. Generally bearing acreage is expected to decline over the next four years–a decrease in bearing acreage of between 50,000 and 100,000 acres between now and 2029 is expected.

"Replanting has absolutely slowed down," says Fumasi. "The reason it has slowed is because of almond economics. They have been very challenging since 2020 through 2023-2024, though over the last 18 months, the economics have gotten significantly better with the price coming up."

After all, pricing hit a low of $1.40/lb. to the grower in 2022-2023. The average price this marketing year, which ends in July, is around $2.50/lb.

"Part of the economic story as well is water constraints," adds Fumasi. "The Sustainable Groundwater Management Act (SGMA) in California limits some groundwater pumping and raises the cost of groundwater extraction. That adds to the cost of production."

Supporting almond shipments

As for shipments, domestic shipments are currently challenged but expected to start recovery. The report notes that in the 2025/26 marketing year, domestic shipments will finish significantly lower year-over-year, but likely not as bad as shipments through October are suggesting. "As macro-economic conditions improve for consumers, domestic shipments will rise throughout the remainder of the forecast period. The increasing popularity of shelled pistachios will be a longer-term headwind for almonds," notes the report.

Fumasi says that there is still room percentage wise for new almond type products or products containing almonds as an ingredient. "That seems to be an area that continues to expand. It's not likely to be the kind of robust growth that we've probably seen in that space over the last 10-20 years. Like anything, as you get to bigger numbers, it makes incremental growth more challenging," he says.

© Almond Board of California

© Almond Board of California

Updates on exports

In exports, shipments are anticipated to barely hit a new record by 2027/28. According to the report, almond export growth will continue in the coming years, albeit at a slower pace than has been seen historically. Export growth is now coming from a much larger base number, which makes incremental increases more challenging. "New export records will be hit then limited due to tighter U.S. supplies. Total U.S. almond shipments – domestic and export – in 2025/26 are expected to be down 3 to 5 percent," notes the report.

"Where we think some of the best growth potential–the most steady and positive growth for the future–is in Southeast Asia with countries such as Malaysia and Thailand. Vietnam is also a good market for U.S. almonds, though a good portion of shipments ultimately make their way to China from Vietnam–Fumasi says that there's always a correlation in when less product is shipped to China directly, more is shipped to Vietnam.

South Korea also still has potential as does the United Arab Emirates, Turkey and India. "India has become our largest single market over the last few years. There are ongoing trade talks with India and lots of potential there but we have to get our trade relationship right with them," says Fumasi.

He also that the European Union, an admittedly more market, also still has potential growth for almond consumption.

Carry in updates

As for carry-in figures, they are expected to rise over the next three years. "That may keep prices where they are, though positive demand forces will help. By 2029, carry-in will start to drop and prices will come along accordingly," notes the report. Higher carry-in is also due to yield improvements on U.S. crops and slower than historic-demand growth.

© Almond Board of California

© Almond Board of California

The pricing outlook

All of that will keep a ceiling on price potential for 2026/27 and 2027/28.

Right now, prices are stabilized but will continue to rise though pricing isn't likely to average USD 3.00+ until 2029/30. The report notes that price strengthening isn't anticipated to be a straight line up. "After two to three years of price stabilization, almond prices should then hit their highest level since the 2015/16 marketing year," it notes.

That said, prices have drastically improved over the past 18 months and are poised to go even higher over the next five years.

Factoring into this are general almond economics which have improved, and are expected to continue to do so over the next five years. That said, it largely depends on the grower. "If the grower owns their land free and clear, then they are solid economically with pricing at $2.50-$3. For the more highly leveraged producers out there that are still making payments on land, they need prices to be north of $3 a pound. That requires a little more patience if our estimates are close to correct," says Fumasi.

For more information:

For more information:

Melanie Bernds

Rabo AgriFinance

[email protected]

https://www.rabobank.com/