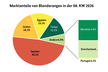

The market for imported mandarins has been growing steadily in recent years, says Amit Sharma, owner of fruit trader Fresko Fruits: "Imported mandarin volumes into India have grown significantly over recent years. In 2023, India imported approximately 19,156.9 tons of mandarins and clementines, nearly doubling from about 9,190.7 tons in 2022. The largest suppliers at this point are South Africa, which has the largest share of over 11,200 tons, China, which supplies around 4,887 tons, and Australia and Egypt, as these countries also contribute notable volumes."

With a large population like India, it shouldn't be a surprise that different consumers have different preferences in terms of mandarin varieties, Sharma explains. "Varieties in the market differ by origin and consumer preference. South Africa's Nadorcott is very popular with Indian buyers due to its excellent eating quality, balanced sweetness, strong color, and ease of peeling. Meanwhile, Chinese mandarins arriving early are noted for high sweetness, though their thinner peels require careful handling. The domestic Indian varieties like Nagpur Santra and Kinnow remain key seasonal local crops, though imports focus on easy-peel, seedless types that fill demand outside the domestic harvest window."

© Fresko Fruits

© Fresko Fruits

Sharma states that it's clear that demand for mandarins in general has been on the upswing in India, and not in little steps: "Demand for imported mandarins in India is growing strongly. Imported volumes have risen sharply, more than doubling within a single year, which points to increasing consumer acceptance and interest in quality off-season fruit. Although India remains a price-sensitive market, it has absorbed higher volumes, and retail demand has stayed resilient even as prices have fluctuated."

According to Sharma, mandarins are now properly sized and graded, which hasn't always been the case in the recent past. "Industry feedback indicates that imported fruit is now being sized and graded more consistently, with buyers placing greater emphasis on uniformity for retail presentation. This marks a change from earlier seasons when size variation was more common. Chinese mandarins are often sold in smaller but sweet, high-quality packs, while South African fruit is generally larger and more uniform, aligning with demand for premium sizing."

Mandarin pricing in India has shown varied movement, Sharma says. "The average import price per ton reached a high point around mid-2022 and has since eased, reflecting greater supply and more competitive inflows. One fresh market report highlighted a decline of around USD 6 per carton, roughly 16 to 20 per cent compared with last season, largely due to increased volumes from South Africa. At the same time, prices differ by origin. For instance, South African mandarins have been reported trading at around USD 18–20 per 10 kg carton in India, a level that reflects both quality attributes and the supply cycle."

There are many factors that can influence the success of mandarins in India in the future, such as cold storage, regulations, and import duties. Sharma emphasizes: "The outlook for mandarin imports into India remains positive. Imports have shown strong historical expansion, rising by more than 108 per cent to reach around 19,000 tons in 2023, with steady year-on-year gains. A wider mix of suppliers has reduced reliance on any single origin and extended seasonal availability. Forward projections point to continued growth through the 2024–2028 period. At the same time, constraints persist, including import duties and regulatory requirements such as cold treatment. Should trade conditions become more favorable and logistics continue to improve, mandarins could establish themselves as a regular imported fruit, with consumption extending beyond major metropolitan areas."

"In the near term, supply is expected to remain consistent, as Chinese mandarins arrive early and South African shipments continue through their season. Prices are likely to stay stable or slightly softer if volumes remain elevated, particularly given the regular weekly arrivals reported by leading importers. Retail demand is expected to remain firm as late winter and early spring approach, when domestic mandarin supplies decline and imported fruit fills the seasonal gap," Sharma concludes.

For more information:

Amit Sharma

Fresko Fruits

Tel: +91 989 19 63633

Email: [email protected]

https://www.freskofruits.com/