Australia's Duxton Farms manages an extensive agricultural asset portfolio, now aimed at a strategic realignment of its holdings, including walnuts, dried fruits, orchards, and bees. By merging companies like Duxton Dried Fruits, Duxton Walnuts, Duxton Bees, and Duxton Orchards, Duxton Farms intends to expand its exposure and increase crop production.

The current portfolio includes a minority interest in proposed merger companies, valued at A$16.5 million (US$10.8 million). This integration aims to broaden commodity holdings across New South Wales, Victoria, and the Northern Territory. Recent transactions include the sale of a majority part of its Kentucky property to Alkira Farms for AU$38 million (US$24.9 million), retaining key land and water entitlements within its portfolio.

The realignment will grow Duxton Farms' lands to over 180,000 hectares (444,790 acres) with significant water entitlements. The expected outcome is to almost double the asset value through these mergers. The imminent mergers will diversify and amplify Duxton Farms' agricultural ventures.

Australia's walnut industry is advancing strategically, valued at $26.5 million in 2023 and predicted to hit $38.3 million by 2032. With a favorable climate, the sector is bolstering yields and quality, with potential export markets including China, New Zealand, and the United States.

Mark Harvey, Independent Director at Duxton Farms, remarked, "Over the past three years, Duxton Farms has been pursuing a strategy to broaden and expand the company's exposure to the Australian agricultural sector. The walnut, dried fruit, apiary, and apples businesses being brought into Duxton Farms are expected to significantly derisk the company's geographic and commodity exposure while expanding and diversifying its earnings profile."

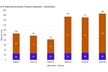

Financial strategies involve securing A$4 million (US$2.63 million) through new share issuance, with the broader merger valued at A$102.9 million (US$67.5 million) across four business segments. Additionally, Duxton Farms is refining its investment management agreement with Duxton Capital, transitioning to a fixed management fee of 1.25 percent of net asset value, thereby streamlining investor fees.

Source: Global AgInvesting