Strong demand growth continued in the Bulgarian tree nut market in marketing year (MY) 2023/24. The domestic demand increase was led by both the retail/food service industry and the confectionery trade. Local production of tree nuts, however, has not kept up with this expanding demand, and in fact, declined last marketing year due to adverse weather (summer drought and heat). This led to surging imports, including from the United States. For MY 2024/25 expectations are for a marginal recovery in local supply, and stable to higher imports and consumption. In MY 2023/24, the United States strengthened its market position as a leading tree nut supplier to Bulgaria, with double-digit growth in Bulgarian imports of U.S. tree nuts to over $14 million.

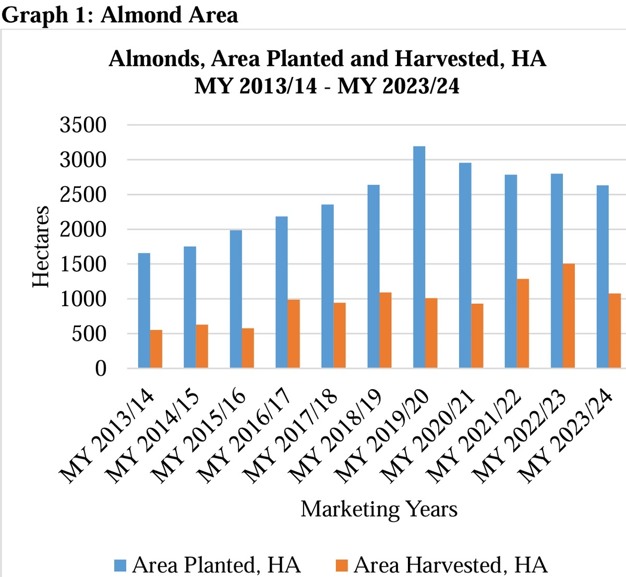

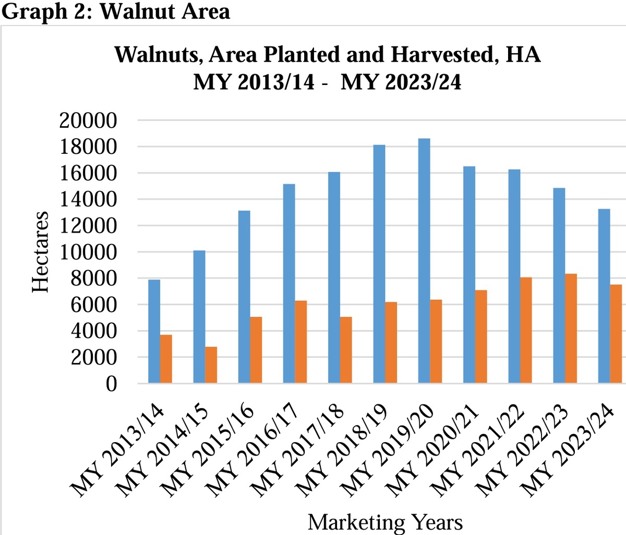

Bulgarian tree nut production (almonds and walnuts) is inconsistent, with wide fluctuations in production in recent years depending on the weather conditions. Harvested areas are consistently far below planted areas as low yields often make harvesting certain orchards not cost-efficient. Bulgaria was a net exporter of walnuts, however, sluggish production, and strong demand for quality products for direct consumption - along with growing demand by the confectionary industry - have driven import increases, and since MY 2020/21 Bulgaria has been a net walnut importer.

Consumer demand rose considerably in MY 2023/24, driven by lower inflation, improved incomes, a recovery in food industry outlets, as well as a better tourist season. Retail sales, especially at specialized snacks-and-nuts retail outlets, proved to be highly popular and profitable. Official statistics data (National Statistics Institute) shows that nut consumption per capita in calendar year (CY) 2023 grew by 14 percent to 1.6 kg from 1.4 kg in CY 2022. This data includes only retail sales and not consumption by the food service industry or for processing, thus actual market consumption is higher. This growth has reportedly continued into the current marketing year.

Bulgaria has good climatic conditions for tree nut production and previously produced enough walnuts to meet consumption needs for direct use and processing. The country also produced a small quantity of almonds for the domestic market.

Almond production is small with a record production of about 1,300 metric tons (MT) in 2018 from a low of only 100 MT in 2008. In recent years, annual production is around 600-900 MT.

Production is concentrated in three regions close to the Black Sea where the climate is the most appropriate for almond trees: Bourgas, Sliven, and Haskovo (Ministry of Agriculture/MinAg Statistical Bulletins, 2023 data). These three regions account for 80 percent of the total planted area. The leading region is Bourgas with a 35 percent share of the almond area. For the structure of almond orchards (MinAg 2023 survey), the highest is the share of orchards of 4-12 years of age category (65 percent), followed by equal shares of younger orchards (below four years of age) and the oldest orchards (above 12 years), each at 17 percent share.

To view the full report, click here.

For more information:

For more information:

USDA

Tel: +1 (202) 720-2791

Email: [email protected]

www.usda.gov