For the first time in many months, inflation for total food and beverages stayed in the single digits. “The March 2023 average price per unit across all foods and beverages and channels increased 9.8 percent over March 2022,” said Jonna Parker, team lead with Circana (formerly IRI). “However, prices averaged 21.43 percent above the March 2021 and 27.4 percent above the March 2020 levels. Salaries are not keeping pace and the grocery marketplace continues to be in flux as consumers move around dollars between channels, products and brands.” Circana, 210 Analytics and the International Fresh Produce Association continue teaming up to document the impact on sales patterns in fresh produce.

The first quarter of 2023 shows in the produce department that national brands represented 82 percent of first-quarter sales, reflecting an increase of 0.3 percent over the first three months of 2022. Private brands were up 6.0 percent over the first quarter.

“The March report demonstrates that there are pockets of growth when zeroing in on certain meal occasions, commodities, holiday periods, private brands, etc.,” said Joe Watson, IFPA’s VP, retail, foodservice and wholesale.

March fresh fruit prices decreased 2.4 percent in comparison to March 2022. Vegetable inflation averaged 3.0 percent in March, which is also down from the 52-week levels.

March fresh fruit prices decreased 2.4 percent in comparison to March 2022. Vegetable inflation averaged 3.0 percent in March, which is also down from the 52-week levels.

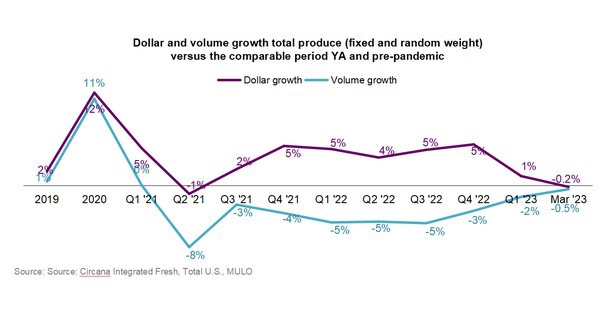

March 2023 fresh produce sales reached $7.1 billion, virtually unchanged from March 2022. Weekly fresh produce sales averaged between $1.394 billion and $1.442 billion.

The more favorable retail prices for fruit resulted in steady volume sales when compared to March 2022. Volume demand for vegetables continued to trend below year-ago levels but moved within 1 percentage point.

“March sales on the fruit side were a mix of dollar gains and losses and a mix of unit gains and losses,” Parker said. “The average price per pound for avocados was down 28.2 percent in March 2023 versus March 2022. This prompted a year-on-year increase of 14.5 percent in pounds, but dollar sales fell by 17.8 percent.” Other items with increased volume sales were grapes, melons, mandarins and pineapples.

Items with increased dollar sales in March 2023 compared with last year were berries, bananas, melons, pineapples and mixed fruit.

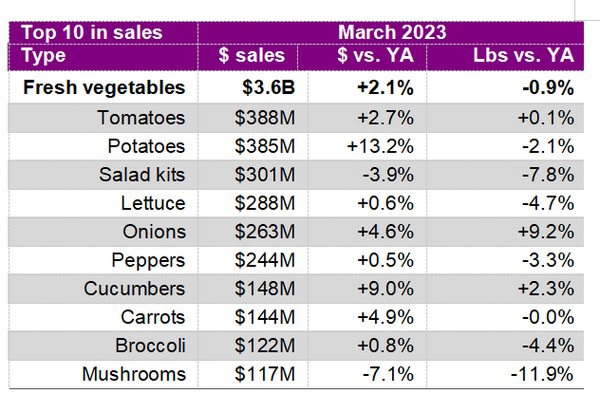

“Dollar and unit performance on the vegetable side is equally uneven,” Watson said. “A few items managed to grow both pounds and dollars--tomatoes, onions and cucumbers.”

The power of value versus convenience can be seen in strong sales for lettuce and salad kits, the number three and four sellers. However, whereas lettuce grew dollar sales, salad kits sales decreased in pounds and dollars.

In March 2023, fresh vegetables added $74.6 million in additional dollars versus March 2022 whereas total fruit lost $84.3 million in sales.

The next report, covering April, will be released in mid-May.

Please click here to see the full report.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

aroerink@210analytics.com

www.210analytics.com