In 2012, this industry produced 208,601 tons of nuts, 102,300 of which were hazelnuts (49%), 93,000 almonds (45%) and 10,200 walnuts (6%).

In 2011, on a total of 176,295 hectares, 33,000 were destined for hazelnuts, 30,250 for chestnuts and 36,890 for almonds.

Again in 2012, imports of nuts equalled to €711 million whereas exports went down by €480 million.

Consumption per head in 2012 was of 3.2 kg/year.

Below image in Italian

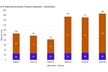

The main actors in the nut chain (click here to enlarge).

Product flows in Italy

As regards imports, 25% of the total 259,082 tons was made up of shelled almonds, 23% by shelled hazelnuts and 10% walnuts.

Turkey affects the Italian market and incoming and outgoing flows. Almonds are imported from Spain and the US, walnuts from France and the US and pistachios from the US and Iran.

The chain

As regards the industry, processing industries (shelling and semi-finished product production) act as an oligopoly: there are not many of them and therefore their bargaining power is high. They have to endure higher transformation costs and volatile prices of the raw materials though.

The nutritional characteristics of the produce are excellent because nuts are rich in unsaturated fatty acids, however, global supply is limited and strongly affected by the weather.

The structure of the businesses

Hazelnuts

Cultivated by 32,995 companies on 64,218 ha in Lazio, Campania, Piedmont and Sicily. The most popular business type is the Utilised agricultural area one, representing 62% of the total, although they only cover 24% of the total land.

Walnuts

The companies producing nuts are 14,302 and the cover 9,524 ha in Campania, Abruzzo, Lazio, Marche and Calabria. Utilised agricultural area companies represent 60% of the total, but they only cover 25% of the total land.

Almonds

The 36,886 companies producing almonds are located on 37,471 ha mainly in Sicily and Puglia. Utilised agricultural area companies represent 59% of the total, but they only cover 23% of the total land.

Chestnuts

In Campania, Tuscany, Calabria, Piedmont, Lazio and Emilia-Romagna there are 30,252 businesses active on 56,801 ha. Utilised agricultural area companies represent 53% of the total, but they only cover 18% of the total land.

While in the EU supply and consumption are going up, North America is still a very important production and consumption area. South America produces mainly counter-seasonal produce and has excellent consumption increase potential.

As regards Asia, Turkey and Asia minor are important producers (pistachios, hazelnuts and almonds) and they too have excellent consumption increase potential.

Short-medium term changes

There are three main causes of change:

The development of transports also intensifies exchanges, especially with countries overseas. This reduces costs and/or transport times but also increases competition.

Finally, research for new conservation techniques enables the development of new products.

To conclude, we can say that, in the short-medium term, the domestic nut fruit sector will have to tackle price volatility, international competition and the lack of aggregation, but it will also be able to count on an increase in demand and chain contracts, the development of new products and the self-transformation into POs.