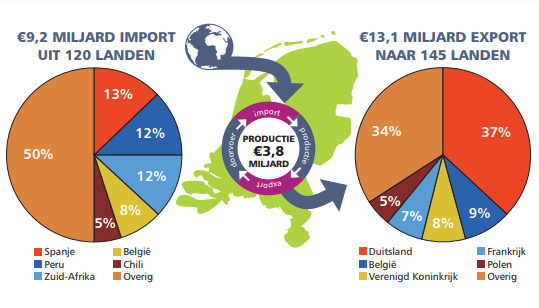

In Europe, the Netherlands led the way in fresh fruit and vegetable trading in 2021. That was despite high transportation costs and sea freight container shortages. Then, there was Brexit and lockdowns too. Fresh fruits and vegetable sales to overseas countries rose to €13.1 billion (+1%). Fresh fruit's export value was as high as in 2020. That of fresh vegetables increased by two percent. Slightly less (-1%) of these fresh products were sold across Dutch borders. That is according to the Fresh Produce Center's 2021 analysis.

Most of the traded fruit and vegetables went to the Netherlands' neighboring countries. In all, 95% remained in Europe. Dutch growers and trading companies are European retail and foodservice partners. They offer the total fruit and vegetable range. Germany (€4.9 billion) is the most important sales market. Belgium (€1.2 billion) and the United Kingdom (€1.1 billion) follow. Fresh fruit and vegetable sales to Belgian customers grew by seven percent. However, exports to the UK fell by 12% compared to 2020.

€9.2 billion imported from 120 countries. €3.8 billion's worth of production. €13.1 billion exported to 145 countries.

Fewer re-exports to the UK

Last year, Dutch-grown products retained their strong trading role in the United Kingdom. But, the Netherlands lost ground as a re-exports trading partner. Compared to the previous year, turnover of the top five products sold to the UK stayed fairly stable. These are tomatoes, bell peppers, cucumbers, strawberries, and onions grown in the Netherlands. The decreased trade to the UK concerns mainly products the Netherlands imports.

It then resells these goods across the channel, i.e., re-exports. That meant fewer avocados, mangoes, blueberries, citrus, and bananas went to the British Isles. There are no import taxes on reciprocal UK/EU trade. That does, however, not apply to products that come from third countries. These import taxes mean British companies buy fewer tropical fruit from Central America via the Netherlands, for example. They do more direct trade with those countries.

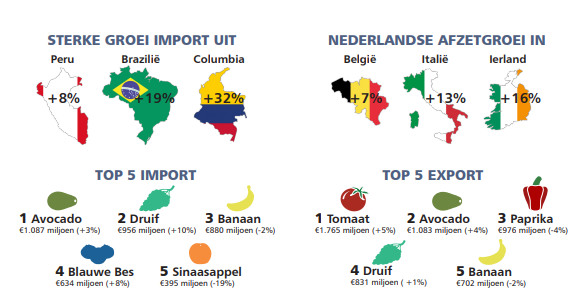

Left: Strong import growth from these countries. Right: Dutch sales growth in these.

Sales growth

Sales to Italy (+13%) and Ireland (+16%) grew the most versus 2020. That is for mainly resold imported fruit and products grown in the Netherlands. Avocado and mango are partly responsible for the sales increase to both countries. But, also, more tomatoes headed to Italy. And Ireland took more onions and bananas. Fruit and vegetable sales in the Dutch market are also on the rise. In 2021, Dutch fresh fruit and vegetable consumption increased by three percent.

Top 10 overseas Dutch fresh fruit and vegetable sales, in € millions. From top to bottom: Germany. Belgium, UK, France, Poland, Sweden, Spain, Denmark, Italy, Norway. Source: Fresh Produce Center/Eurostat/Fruit & Vegetable Facts; R = Estimate.

The Netherlands' fruit and vegetable sales to far-away counties were generally difficult. That was due to high transport costs. Airfreight tariffs were sky-high, and there were fewer passenger flights. These often have bell peppers in their cargo hold. In 2021, Dutch bell pepper exports to the United States (US) virtually stopped.

They reached a mere 1 million kg. By comparison, in pre-COVID 2019, the Netherlands sold more than 16 million kilos of bell peppers to the US. Dutch onions, however, remain popular worldwide. Sales grew in countries like Ivory Coast, UK, Gambia, and Nicaragua.

Fruit imports stagnated

In 2021, Dutch trading companies imported €9,2 billion's (+3%) worth of fresh fruit and vegetables. Fruit imports had been increasing more than those of vegetables. But, that trend did not continue in 2021. Vegetable imports increased by nine percent; fruit by only one.

Still, fresh fruit imports make up more than three-quarters of total imports. The top five import products are avocadoes, bananas, grapes, blueberries, and oranges. Vegetables on the rise are tomatoes, bell peppers, onions, and sweet potatoes. For fruits, more grapes, apples, and blueberries were imported.

Peru gains ground

Spain, Peru, and South Africa are the top three fresh fruit and vegetable countries of origin. Imports from Peru, in particular, continue to rise sharply. Between 2016 and 2021, those have more than doubled, reaching €1.1 billion. Peru's main products are avocadoes, blueberries, and mangoes. Brazil (+19%) and Columbia (+32%) are the biggest climbers for Dutch fruit imports.