Along with facing the usual weather challenges, Canadian fruit and vegetable farmers had to contend with labour shortages in 2020 as a result of the COVID-19 pandemic. Nevertheless, farmers adapted: compared with 2019, fruit and vegetable sales were down 0.8% to $2.5 billion, while harvest area was down 1.4% to 180,815 hectares.

The horticulture sector is labour-intensive and relies on temporary foreign workers. The COVID-19 pandemic delayed the flow of these workers into the country, resulting in labour shortages. In 2018, for example, 54,734 temporary foreign workers were employed in the agriculture sector. That year, slightly more than half of these temporary workers were employed at fruit and tree nut (27.1%) or vegetable and melon (24.1%) farms, while one-third worked at greenhouses, at nurseries and in floriculture (33.6%).

Vegetable sales rose 2.5% to $1.3 billion in 2020, with the increase attributable mainly to higher farm-gate prices, while, for some commodities, yields were slightly above their respective five-year average yield. The sales increase was driven by higher sales of cabbage (+9.6%), sweet corn (+7.4%) and tomatoes (+6.4%). According to the Consumer Price Index, annual fresh vegetable prices rose at a much slower pace in 2020 (+3.0%) compared with 2019 (+12.7%).

Fruit cultivated area was stable in 2020 at 129,800 hectares, while bearing area fell 1.4% to 86,463 hectares. Fruit sales fell 4.3% to $1.2 billion, attributable mainly to lower sales of sweet cherries (-18.9%), grapes (-13.1%) and blueberries (-10.0%). Conversely, cranberry sales rose 16.1% to $154.9 million, primarily because of a rebound in sales in British Columbia, where the farm-gate value had fallen by 40.1% in 2019.

Sales of first spring vegetables and early summer fruits down from 2019

Asparagus, one of the first vegetables to be harvested in the spring, was the first crop affected by labour shortages resulting from travel restrictions in March and April. Production fell by one-quarter (-24.3%) to 7.7 million kilograms—well below the five-year average of 9.0 million kilograms. The decline in asparagus sales was less pronounced (-7.7% to $41.6 million) because farm-gate prices rose by over one-fifth (+18.4%).

Strawberry production (-11.4%) and sales (-2.3% to $127.5 million) were down compared with 2019, despite the popularity of u-pick activities during the COVID-19 pandemic. Census data show that over two-thirds of strawberry farms (69.0%) reported farm-gate sales as well as stand, kiosk and u-pick sales in 2016.

Strawberry farmers in Nova Scotia (-16.9%) and Ontario (-10.2%) reported large sales declines in 2020, while sales in British Columbia were up 7.5% from 2019 and above the five-year average.

Fruit production hampered by spring frost and inclement summer weather

In British Columbia, fruit farmers reported lower levels of production for raspberries (-19.2%), sweet cherries (-18.6%), vinifera grapes (-15.2%), highbush blueberries (-13.7%) and apples (-12.1%). The declines were attributable to a late spring frost, followed by cooler summer temperatures in the Okanagan Valley.

Spring frost and summer drought conditions reduced wild blueberry production in the Maritimes, which affected national production downward by almost one-fifth (-18.9%) compared with 2019. Although farmers received higher prices for their crops, sales fell 8.3% to $112.2 million.

Wild blueberry production in Quebec rose 10.7% to 34.4 million kilograms, accounting for half of the national crop. Sales were up 1.2% to $53.0 million.

Fruit farmers in Ontario, who grow most of Canada's tender fruits, reported lower marketed production of sweet cherries (-17.5%), peaches (-15.5%), sour cherries (-14.7%), plums and prunes (-13.8%) as well as pears (-7.4%). Despite higher prices, farm-gate values were down for sweet cherries (-15.7%), peaches (-12.9%), sour cherries (-10.7 %) and pears (-3.0%).

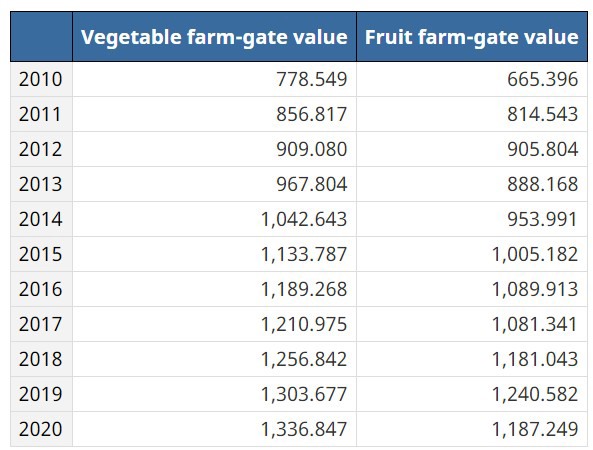

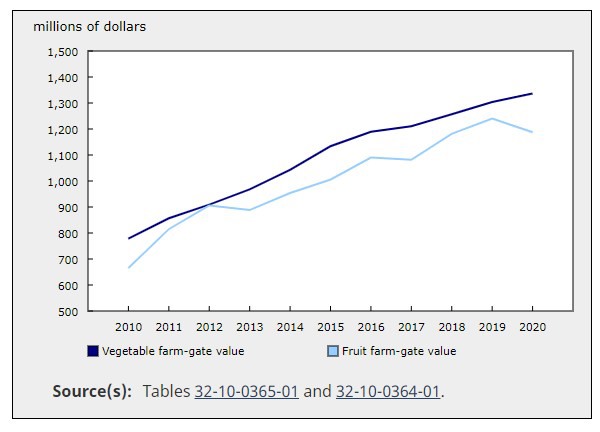

Chart 1: Farm-gate value of fruits and vegetables

Chart 1: Farm-gate value of fruits and vegetables

Farm-gate value of fruits and vegetables

Apple production rose 2.1% to 391 million kilograms, while sales rose 5.4% to $259 million, in part because of the popularity of u-pick apple orchards, considered a safe family outing during the pandemic.

Conversely, the mild fall weather was bad for root and storable vegetable farmers, particularly in Quebec, where farmers reported root suffocation problems related to dry and warm soil.

Nationally, carrot harvested area (-5.8% to 7 531 hectares) and marketed production (-6.0% to 333.9 million kilograms) were both down from 2019.

Dry onion production (-8.5%) was also down, but sales rose 1.0% to $113 million as a result of higher prices.