November sales are dominated by the all important Thanksgiving holiday — one of the largest retail opportunities in produce and many other retail departments. This makes it a hard-to-beat sales occasion any year. However, throughout October and November, shoppers’ concern over Covid-19 rose along with the number of new cases. This resulted in very different Thanksgiving celebrations versus typical years, with less travel, smaller gatherings and earlier shopping to avoid crowds. Much like seen throughout the year, elevated concern also translated into a greater spending at retail versus foodservice. During the month of November, sales for all food-and-beverage-related items (total edibles) increased 9.3%, which was up from 8.6% during the month of October.

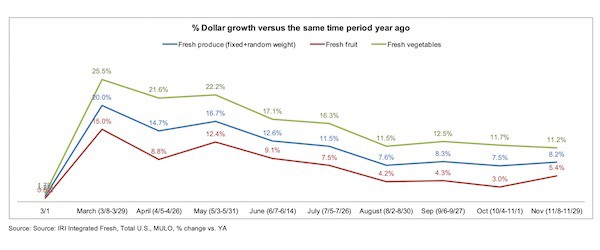

As seen throughout the pandemic, frozen fruits and vegetables have the highest growth, but are also the smallest of the three temperature zones in retail. Frozen fruit and vegetable sales increased 15.6% in November versus year ago versus 8.2% for fresh produce. The 8.2% gain for fresh produce was slightly higher than the 7.5% during the October weeks and gains year-to-date remain unchanged at +10.0% versus the same time period in 2019.

Fresh produce generated $4.9 billion in sales during the November weeks — an additional $380 million in sales versus the same time period in 2019. This encompasses $107 million in additional fruit sales and $273 million in additional vegetable sales. Vegetable sales have outpaced fruit sales throughout the pandemic and have generated double-digit growth since the onset of the pandemic shopping patterns in mid-March. Fruit did have its best performance since July 2020.

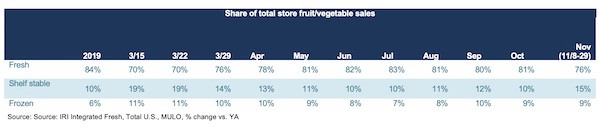

Fresh share

Looking at total fruit and vegetable dollars in fresh, shelf stable and frozen shows a majority share for fresh, at 76%. While this is below average against the entire 2019 calendar year (84%), this share moves up and down throughout the year. In November 2019, the fresh share of total dollars was 76.6% versus 76.1% in 2020.

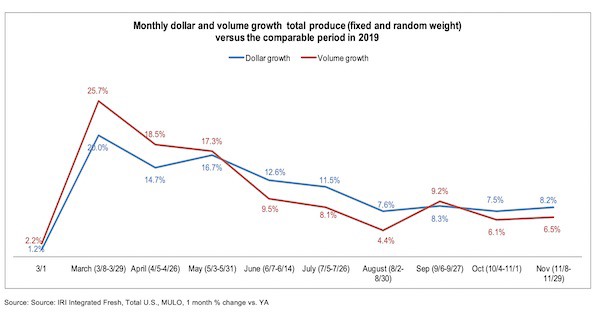

Fresh produce dollars versus volume

In September, volume sales briefly exceeded dollar sales on aggressive Labor Day pricing. But in October and November, dollar gains once more outpaced volume driven by vegetables.

“Retail fruit sales were perfectly in balance,” said Joe Watson, VP of Membership and Engagement for the Produce Marketing Association (PMA). “Both volume and dollars were up 5.4% in November versus a year ago levels. Vegetables had an increase of 11.2% in dollars and 7.5% in volume.”

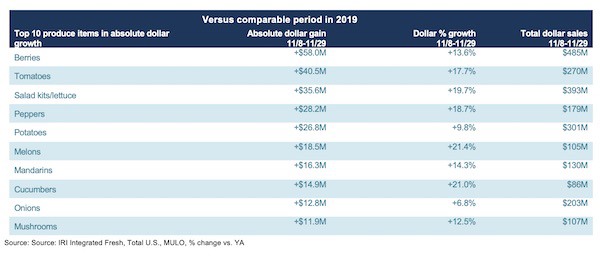

Absolute dollar gains

“The November Top 10 in absolute dollar gains reflects some familiar faces, led by berries, tomatoes and lettuce,” said Watson. “Mandarins make an appearance in the top 10 instead of oranges as people’s Vitamin C immune-boosting fruit of choice, with a 14.3% increase versus year ago, reflecting an additional $16.3 million in sales. Cucumbers and mushrooms are the smallest of the categories making it into the top 10, with mushrooms having been a retail powerhouse since March.”

To read the full report for November, click here.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

Email: aroerink@210analytics.com

www.210analytics.com