The COVID-19 pandemic has significantly impacted the way consumers buy fresh produce. The ‘homebody economy’ looks set to stay. Our new normal means many of us are working from home some or all of the time; we are eating more food at home and eating out less often. Nielsen Associate Director Melanie Norris reports.

During the COVID-19 pandemic, we have seen a surge in vegetable sales; an increase in the number of consumers, both here and around the world, engage in online shopping; and a notable shift toward pre-packed produce options.

The move to pre-packed produce

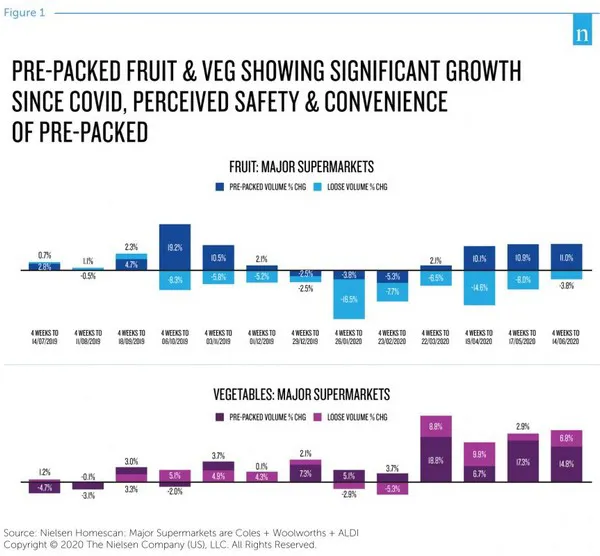

A year ago, pre-packed fruit and vegetables made up 42 per cent of the volume sold in major supermarkets. Post the onset of COVID-19, volume share has increased to 45 per cent. This trend was more than likely driven by the need to limit time in the supermarket, food safety, convenience, or a combination of all three. This trend is set to continue, making it critical that consumers always have access to the right offer.

In the coming months, as economic uncertainty becomes a reality for many households, we need to consider the probable shift toward value-for-money products. On the one hand, large multi-packs may offer the best value, but they may be out of reach for people short on cash. Cash-strapped consumers may be forced to buy smaller pack sizes, bearing in mind that 43 per cent of households are 1-2 person and having an offer to satisfy both types of consumer is important.

The issue of sustainability should also be considered when it comes to pre-packs. While we know that sustainable benefits are not as preferred right now by consumers, this isn’t to say that they won’t be again in the future. How can we innovate in this space to satisfy consumer demand and sustainability requirements?

The rise of local

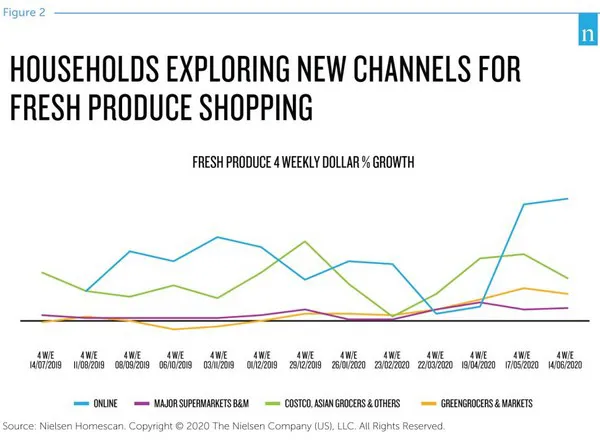

Since the start of COVID-19, many households have begun shopping in new channels. Driven initially by out-of-stocks and people working from home some or all of the time, households are now choosing to prioritise convenience for where they do their shopping.

Greengrocers and markets have picked up sales with the emergence of this trend; and shopping locally, from both a product and a retailer perspective, is a trend we’re seeing globally.

Over the past 12 weeks, greengrocers and markets have gained 1.2 share points of fresh produce, while other independent supermarkets grew 1.8 share points. In the United Kingdom, 25 per cent of shoppers are shopping at their closest store more often. This is similar to Australia.

The rise of online fresh produce shopping

COVID-19 has accelerated online adoption faster than what has been recorded in recent years, with shoppers wanting to reduce contact with other shoppers. During the last 12 weeks, online represented eight per cent of total grocery sales in Australia, up from five per cent this time a year ago. Online represented six per cent of fresh produce sales in Australia, up from four per cent a year ago. The oldest and youngest demographic groups are leading the growth in online spending.

Consumer behaviour must be repeated to become habitual, and during the months of March to June 2020, nearly two-thirds of households were repeat purchasers of fresh produce online – suggesting that this has become their new normal. Sales data from other countries, such as the United States and China, show that this channel continues to grow as the pandemic progresses.

In Australia, Woolworths and Coles are nearly three-quarters of online fresh produce sales; however, as these retailers struggled to meet demand during March and April, smaller online outlets such as fruit and veg box providers and specialty stores gained some share. In the UK, produce farms are thriving during the crisis as more people shift to fruit and veg box deliveries.

For fresh produce to take advantage of online growth, we need to address some of the reasons why shoppers prefer to buy in-store. Having a technology strategy to move quickly i.e. scheduled/same day delivery, ability to choose ripeness and size are essential to succeeding in this space.

For more information:

Melanie Norris

Nielsen

Email: melanie.norris@nielsen.com