The latest HMRC trade data covers up to June 2020 giving the full season of July-June 2019/20. Data shows that both imports and exports of potatoes (both fresh and frozen) were down year-on-year and against the 3-year average.

The latest HMRC trade data covers up to June 2020 giving the full season of July-June 2019/20. Data shows that both imports and exports of potatoes (both fresh and frozen) were down year-on-year and against the 3-year average.

Import

Imports of fresh and processed potatoes (product weight) for the 2019/20 season totalled 1.03Mt. This is down 10% from the 3-year average and 33% year-on-year.

Imports of fresh potatoes for the 2019/20 season totalled 203.0Kt, down 3% year-on-year. 830.9Kt of processed potato products were imported into the UK from July-June which is a drop of 38% year-on-year. Processed potato imports have been lagging behind last season since March but the drop has increased as the months have progressed.

The top 5 import origins of processed and fresh potatoes generally make up c.91% of total imports and in 2019/20 this has not differed. However, we have seen a drop in imports from all of the top 5 origins compared to the previous season and all but 1 of the top 5 against the 3-year average.

A drop in imports is not unexpected as the coronavirus pandemic has weighed heavily on demand as a whole since March 2020. With overall demand reduced the need for imports would also drop off.

Export

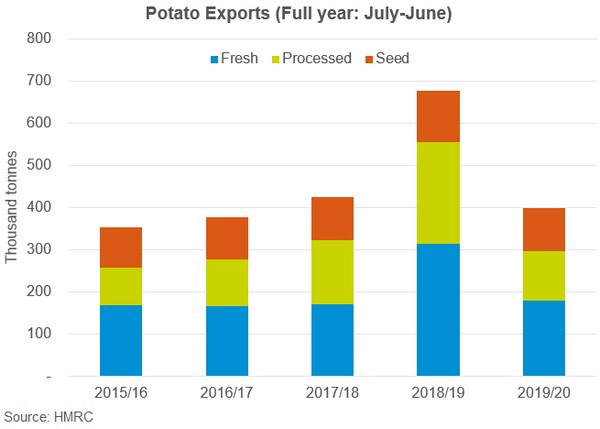

Exports of fresh and processed potatoes have also dropped off. Exports of fresh potatoes have been tracking well behind both the 2018/19 season and the 3-year average since February. Last season (2018/19), especially in the latter half of the season, we saw a big rise in exports of fresh potatoes to Eastern Europe.

In just January – June 2019 we saw 235.7Kt of fresh potatoes exported but the whole season of 2018/19 (July-June) sat at 314.6Kt. Compared to the previous 3-year average for the whole season this is up 88%. Even if we classed 2018/19 as an anomaly and worked a 3-year average out based on season 2015/16-2017/18 exports of fresh potatoes have still been tracking behind since February.

As an export destination. Poland made its way into the top 5 for the UK last season (2018/19). We have seen exports more than half to this destination this season (2019/20) yet it still remains number 4 with 19.9Kt exported there from the UK. The other 4 of the top 5 export destination for the UK in 2019/20 have also seen declines compared to last year. Again some of this trade will have been majorly affected by the coronavirus pandemic curbing overall demand within these countries and it is likely to be no major surprise to see exports reduced.

Weekly report

Free-buy markets are still somewhat pressured this week, reduced trade is harming price coverage as free-buy markets aren’t operating at their normal tonnages.

HMRC data shows some increased support for the foodservice sector since the introduction of the Government’s Eat Out to Help Out scheme. However, this increased demand is yet to be realised within the domestic potato market.

The long dry period has generally ended across the UK, with heavy downpours in many regions. Although helping to replenish parched soils, new issues may be presented.

Packing

New-crop potatoes are now being lifted in many regions around the UK, which is creating increased supply. This increased supply, alongside limited demand is negatively pressuring prices.

Contracted sales still account for most of the trade within the packing market this week, with free-buy demand subdued.

Reports suggest some growers unwilling to sell at such low prices, limiting the amount of trade taking place.

Bags

“Staycations” are offering some support to coastal trade, although trade is still very limited in many central regions.

Talk within market of ‘full price’ chip shop takeaway options become secondary choice to ‘half price’ eat-out alternatives, especially during the first half of the week.

With lifting underway, supply continues to outstrip demand.

Processing

Overall processing demand for free-buy material remains weak despite some reports of increased demand for french fries. It’s likely that this increase is still being met by contracts.

Small volumes of Maris Piper trade continue, at a premium to general whites.

Exports

Oversupply of potatoes on the continent is limiting export opportunities, but there have been some reports of exports to Belgium.

Exports to the Canary Islands are happening, but generally in reduced volumes as the coronavirus pandemic weighs on the tourism sector.

Source: AHDB