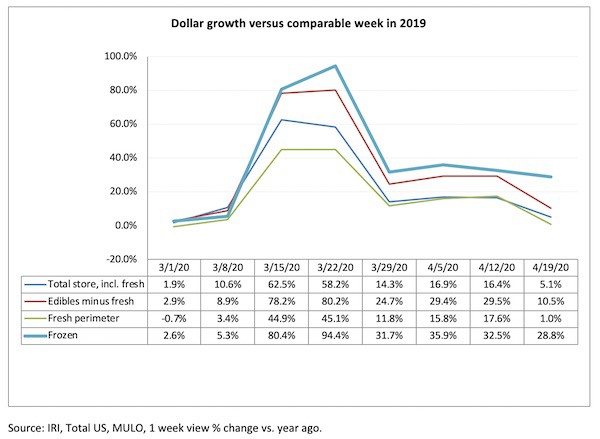

Since the onset of coronavirus in the United States, grocery shopping patterns have been vastly different in terms of elevated spending, day of the week, day part, product and brand choices, and online engagement. The week ending April 19 marked the seventh week of coronavirus-related shopping patterns. In-home consumption is here to stay for the foreseeable future and the additional demand continued to push retail sales well above prior year levels, despite going up against the later 2019 Easter, that fell on April 21. During these past six weeks, the frozen foods department has emerged as a sales leader across edibles and the week of April 19 was no different. 210 Analytics, IRI and AFFI partnered up to understand the effect for frozen food in dollars and volume throughout the pandemic.

During the week of April 19, frozen food sales continued to show highly elevated levels, with dollars up 28.8% over the comparable week in 2019. Despite another strong week for meat (+17.3%), the total perimeter increased just 1.0% due to the decreases in deli and bakery. Center store edibles increased 10.5%. Frozen foods generated nearly $1.4 billion in the week of March 29, 2020 — over $332 million more than the comparable week in 2019. Frozen food unit sales were up 22.9%.

A deep-dive into frozen food sales

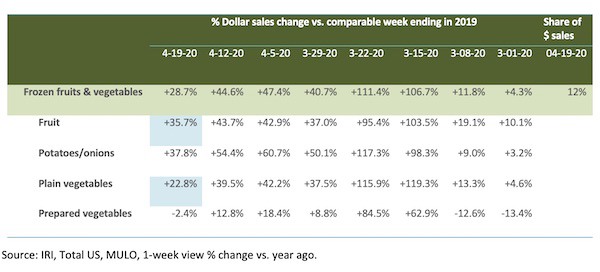

The largest share within frozen foods, frozen meals, increased more than 20%. This was driven by continued appetite for frozen pizza, that was up 51.1% over the week ending April 19 versus the comparable week in 2019. The overall frozen fruit and vegetable category was up 28.7% in the week of April 19 versus the same week last year. Within this category, potatoes and onions were the main driver with sales up 37.8% over the week ending April 19 versus the same week a year ago.

Lessons from overseas

Overseas sales patterns can help shed some light on what may lie ahead. After very similar weeks of stockpiling as seen in the U.S., most countries seem to have shifted to continued elevated purchasing levels for total edibles, with mixed engagement with fresh (meat, produce, bakery, etc.). For food, the everyday baseline for the week ending April 12 (Easter week) trended about 20% above the comparable week in 2019 for all countries. Non-edible sales have mostly leveled off and declined for some. Frozen food continues to see above-average gains in all countries, but Spain.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics

Tel: +1 (210) 651-2719

Email: aroerink@210analytics.com

www.210analytics.com