The American Pecan Council released its December 2025 shipment report, covering the fourth month of the 2025/26 marketing year. Volumes are reported on an in-shell equivalent basis, with kernel weights normalized using a 2.0x conversion factor.

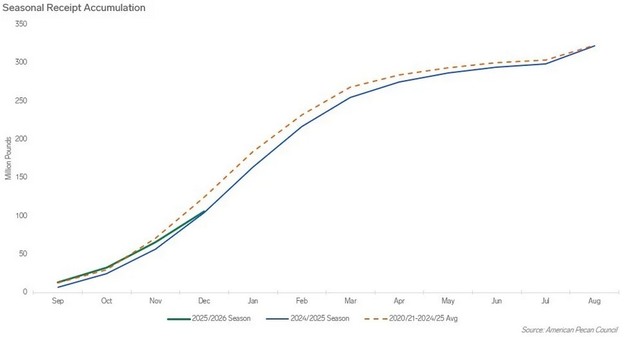

December receipts totaled 40.4 million pounds, up 21 per cent month-on-month from November's 33.4 million. However, receipts declined 19 per cent compared with December 2024 at 48.2 million pounds and were 25 per cent below the five-year December average of 54.2 million.

Season-to-date receipts through December reached 106.2 million pounds, largely in line with the previous year at 104.8 million, but 15 per cent below the five-year September to December average of 124.7 million. Improved pecans represented 90 per cent of receipts, native pecans 3 per cent, and substandard material 7 per cent.

© Mintec/Expana

© Mintec/Expana

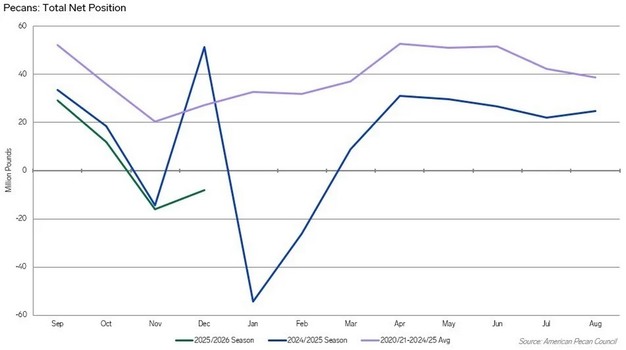

Total inventory at the end of December stood at 132.5 million pounds, up 7 per cent from November but 18 per cent below December 2024 and 27 per cent below the five-year average of 181.5 million. Shelled meats accounted for 49 per cent of inventory, with in-shell product at 51 per cent.

Industry participants attribute lower receipts to hurricane damage in late 2024 and drought conditions in 2025 across the U.S. and Mexican growing areas.

December shipments totaled 29.6 million pounds, down 13.3 per cent year-on-year and 31.5 per cent below the five-year December average. Domestic shipments accounted for 25.0 million pounds, while exports totaled 4.6 million pounds.

Through the first four months of the marketing year, cumulative shipments reached 147.3 million pounds, down 7.1 per cent year-on-year and 12.8 per cent below the five-year average. Domestic shipments totaled 125.5 million pounds, down 5.6 per cent year-on-year, while exports reached 21.7 million pounds, a decline of 15.6 per cent.

© Mintec/Expana

© Mintec/Expana

Commitments at the end of December stood at 140.6 million pounds, up 34 per cent compared with December 2024 but 9 per cent below the five-year average. The net position, defined as inventory minus commitments, registered at negative 8.1 million pounds, compared with negative 16.0 million in November. A negative position indicates contracted volumes exceed on-hand inventory.

Market participants report firm price levels amid constrained supply, although shipment volumes remain below historical norms. Receipt inflows during the December to February peak period and potential imports are expected to influence market coverage into early 2026.

Source: Mintec/Expana