Over the past decade, blueberries have shifted from a niche product to one of the most traded fresh fruits globally. Production has risen from around one million tons to more than two million tons, despite disruptions linked to pandemics, geopolitical tensions, logistics constraints, rising costs, labour availability, and climate variability. The discussion within the sector has moved from expansion toward managing growth within a more complex market structure.

Between 2015 and 2025, growth was driven by rapid acreage expansion, the entry of new producing regions, and increased investment. The 2024 to 2025 period marked a change, as markets placed greater emphasis on fruit quality and consistency. Volume without meeting commercial specifications increasingly lost market access. As a result, the projected target of 3,5 million tons by 2030 is increasingly linked to production efficiency, updated genetics, and adequate infrastructure.

Price formation is expected to become more sensitive as supply continues to grow. Blueberries have historically maintained higher price levels even with rising volumes, supported by demand growth. Toward 2030, overlapping supply windows, additional origins, and more mature markets are expected to increase pressure on prices. Inconsistent fruit is likely to be excluded from commercial channels regardless of pricing.

Production geography continues to evolve. The Americas remain a core production zone, although their share has fallen below 50 percent of global output. Peru continues to play a leading role, supplying fruit across extended seasonal windows. Chile faces challenges linked to aging orchards and cost competitiveness, while Mexico is focused on improving efficiency and reducing dependence on the United States market. Production in the United States is expected to remain stable, with growth linked mainly to domestic consumption and premium segments.

Europe remains a key consumption market but faces constraints on local production expansion due to regulatory, labour, and resource limitations. This maintains reliance on imports, particularly outside the domestic season.

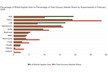

Africa and Asia are increasingly relevant to future growth. African blueberry plantings have expanded by more than 370 percent in ten years, with Morocco among the main contributors, supported by yields, proximity to Europe, and logistics. Other countries, including Zimbabwe, Zambia, Kenya, and Namibia, are developing export-oriented supply, with future performance linked to water availability, infrastructure, and market planning. Asia, particularly China, is expected to grow both as a producer and consumer, with demand tied to quality standards and logistics performance.

Infrastructure and post-harvest capacity remain central considerations. Blueberries require continuous cold chain management and efficient logistics. Climate conditions are also reshaping production zones, while genetics, data use, automation, and artificial intelligence are increasingly integrated into orchard and packing operations.

Consumer expectations have also evolved, with demand focused on consistency, flavour, traceability, and sustainability. Reaching 3,5 million tons by 2030 will depend on aligning production growth with quality management, supply chain coordination, and market requirements rather than volume expansion alone.

Source: Blueberries Consulting