The Mexican tomato season has started more slowly than in recent years, according to industry sources, as growers and exporters adjust to a major change in U.S. trade policy that has introduced new uncertainty into the market.

In mid-July, the U.S. government withdrew from the Tomato Suspension Agreement (TSA) with Mexico and imposed an antidumping tariff of 17.09% on most fresh tomatoes imported from Mexico. U.S. authorities said the tariff reflects findings that Mexican exporters were selling tomatoes below fair market value, a practice classified as dumping under U.S. trade rules.

The TSA, first introduced in 1996 and most recently renewed in 2019, had suspended antidumping investigations provided Mexican exporters complied with minimum reference prices and export conditions. Negotiations failed in 2025, leading to the lapse of the agreement and the activation of the duty.

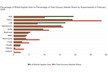

The U.S. Commerce Department said the measure is intended to support domestic tomato growers, particularly in Florida, who argue that rising Mexican imports have reduced their market share. Mexico is estimated to supply between 70% and 90% of the U.S. fresh tomato market, compared with about 30% two decades ago.

Importers, retailers, and foodservice operators have raised concerns that the tariff could push up prices and constrain supply, especially for varieties such as grape, cherry, and vine-ripened tomatoes that are largely sourced from Mexico. Some market participants view the tariff as a cost increase that may be passed along the supply chain, potentially affecting consumption.

Mexico's government and grower organisations have criticised the tariff and responded by implementing minimum export pricing across tomato categories, aiming to maintain trade flows and limit market disruption.

The policy shift is already influencing production decisions. In key growing regions such as Sinaloa, planted area is reported to be down 18% to 25% year on year, as growers reduce exposure amid uncertainty over demand, pricing, and net returns.

Seasonal pricing patterns have also been affected. In a typical year, tomato prices firm in late September and early October as summer production tapers off and before peak winter volumes enter the market. This season, that price lift did not materialise, despite expectations that the tariff could tighten supply and support higher prices.

As the market progresses further into the Sinaloa production window, reduced plantings, muted price response, and the ongoing impact of the antidumping tariff continue to shape market conditions. Growers, exporters, and buyers are monitoring supply development and demand closely to assess whether normal seasonal dynamics will reassert themselves later in the winter or whether volatility will carry into the next production cycle.

Source: Mintec/Expana