Global fresh fruit markets are undergoing structural change, according to Rabobank's latest World Fruit Map published in July 2025. While many trends from the 2018 edition continue, such as strong demand for blueberries and avocados and the dominance of the U.S. and Europe in fruit imports, the report outlines new shifts driven by climate conditions, cost pressures, and evolving consumer preferences.

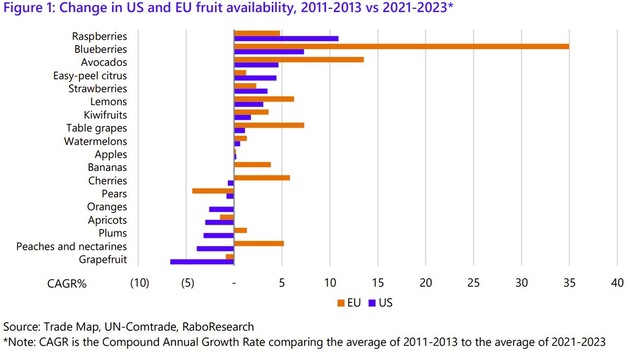

Blueberries and avocados remain among the fastest-growing fruits in both the EU and the U.S., despite their higher price points. Raspberries and sweet cherries are also gaining traction, while traditional fruits like oranges, pears, apricots, and grapefruits have declined in availability. Global frozen fruit exports rose from U.S.$4 billion in 2013 to U.S.$6.9 billion in 2023, partially reflecting rising costs.

In China, durians and sweet cherries have seen a surge in popularity, largely driven by their status as festive gifts. Thailand and Chile have benefited from this demand, with durians becoming a key export for Thailand, despite limited appeal outside Asia.

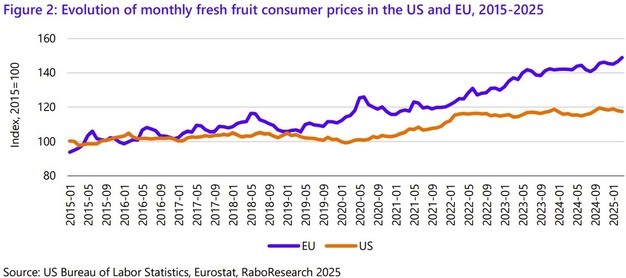

Consumer prices for fresh fruit have sharply increased since 2020. As of January 2025, prices in the EU were 30 percent higher than five years earlier, while U.S. prices rose by 19 percent. While prices stabilized in the U.S. after a spike in 2022, certain processed fruits, particularly orange juice, saw even sharper increases. Frozen concentrated orange juice futures rose 370 percent from January 2020 to January 2025, a result of disease outbreaks and weather-related disruptions in Brazil and Florida.

Latin America continues to solidify its role as a key exporter. Mexico rose to second place globally in export value, while Peru and Thailand advanced to seventh and sixth, respectively. The U.S. dropped from second to fourth place over the past decade. Spain remains the world's top exporter, while the Netherlands retains its role as a central EU import hub. Despite global fruit production growing at an annual rate of 1.7 percent, domestic production in the EU and the U.S. has declined, increasing import dependency, particularly for tropical fruits and out-of-season supply.

Soft and tropical fruits, such as berries, avocados, mangoes, and durians, are driving global trade growth, while apples, oranges, and pears have stagnated. The use of proprietary fruit varieties is also rising, especially in export-oriented countries. For instance, proprietary grapes now represent about 80 percent of Peru's and South Africa's table grape exports, up from less than 20 percent in 2017. As costs, climate risks, and regulatory pressures grow, investment in logistics, storage, and disease-resistant varieties is seen as vital for maintaining fruit availability and affordability in global markets.

To view the full report, click here.

For more information:

For more information:

RaboBank

Cindy van Rijswick

[email protected]

Gonzalo Salinas

[email protected]

David Magana

[email protected]