In terms of EBIT (Earnings Before Interest and Tax), the major shipping lines recorded a combined EBIT of USD 41.6bn, and this is discounting CMA CGM who have only issued a press release so far, which does not list their EBIT. This not only higher than the combined Q2 EBIT of the past 11 years but is also right at the top with the 2021-Q4 and 2022-Q1 EBIT; once CMA CGM’s EBIT is included in the list, 2022-Q2 would likely become the most profitable quarter in the last decade.

We should stress that we do not mean this as a value judgement on whether shipping lines making money is a good or a bad thing, and we note it has generally been an unprofitable business for the past decade or so; we are merely pointing out the unprecedented nature of the current market dynamics.

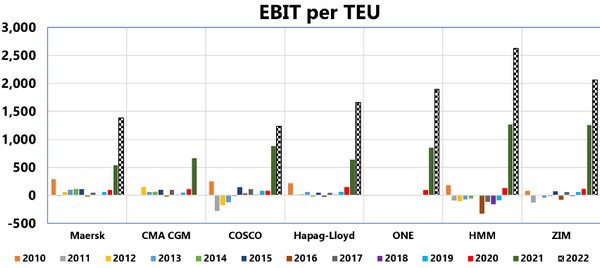

To see just how unprecedented these profits are, the figure above shows the EBIT/TEU for the carriers that publish both their EBIT and their global volumes. Please note that we are still missing CMA CGM for 2022-Q2. The 2022-Q2 EBIT/TEU figure of each of these shipping lines dwarfs each of the previous years, with the latter hardly relevant in context of the outsized EBIT/TEU numbers that we are seeing right now. These figures are backed by a Y/Y increase in freight rates in 2022-Q2.

This level of profitability, however, might not continue into Q3, due to the fast-falling freight rates, and the slowdown in global demand.

For more information: sea-intelligence.com