Global fresh blueberry exports are likely to expand steadily during the next few years, as growing regions continue to diversify around the globe. Companies are pushed to be more productive and more efficient and to consistently provide high-quality fruit. Improved cultivars will play an increasingly significant role across growing regions.

According to the latest fresh produce report from Rabobank, the global highbush blueberry planted area surpassed 205,000 hectares in 2020, and production is expected to continue to grow firmly in the next few years. Most of the planted area is still concentrated in the Americas, but the Asia-Pacific region is expanding fast. North America, the cradle of the blueberry industry, continues to be a relevant blueberry-growing region, but production shares are shifting, with South America expanding rapidly, and new growing regions also being developed in Europe, Africa, and Asia.

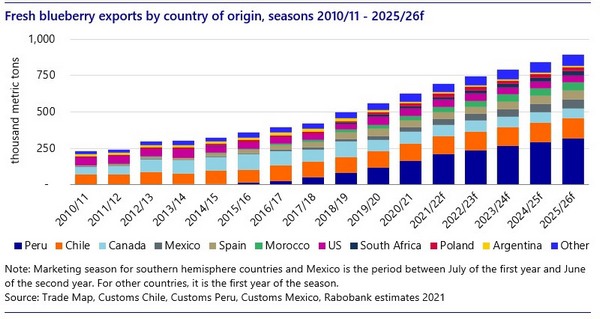

“We expect global exports in 2025/26 to reach close to 900,000 metric tons, with over 70% coming from the top-five exporting countries: Peru, Chile, Canada, Mexico, and Spain/Morocco,” says David Magaña, Senior Analyst – Fresh Produce at Rabobank in North America.

Expanding global demand

Global blueberry export volume has grown at a compound annual growth rate (CAGR) of about 11% during the recent decade. International shipments and availability have exploded in the last decade, fuelled by the rising production of new actors in the industry, such as Peru, Mexico, Morocco, South Africa, and China, which complements the existing supply from the US, Chile, Argentina, and local supply from Europe. Since the 2019/20 season, Peru has become the largest global fresh blueberry exporter, and Chile is now the second-largest global exporter of blueberries.

“Both Chile and Peru have outstanding market access, with tariff-free access to China, Europe, and the US. These countries are well-positioned to benefit from expanding global demand,” explains Gonzalo Salinas, Senior Analyst – Fresh Produce at Rabobank in South America.

A shifting demand landscape

In terms of consumption, the US and Canada combined still absorb the highest blueberry volume, but Europe is now the main source of demand growth. In the same way, China is leading blueberry consumption in Asia thanks to the growth of its local and imported supply. The demand landscape is going from being North America-centric to having diverse engines around the globe.

Improved cultivars to play a key role across growing regions

As the market becomes more competitive and consumers more demanding, consistent quality is vital to seize the growth opportunities. “Breeding programs are developing cultivars for different chill requirements, focusing on flavor, firmness, and shelf life to appeal to more consumers and retailers. Growers may benefit from higher input efficiency, better yields, and the potential for mechanical harvesting,” according to Magaña.