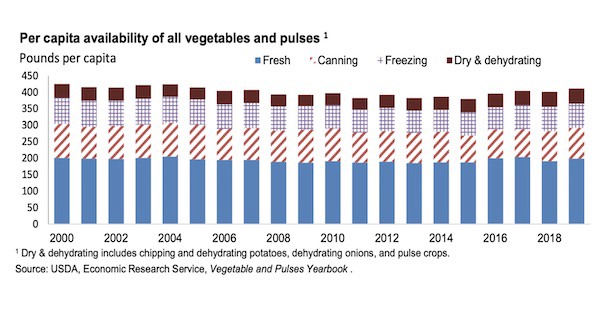

In 2019, total U.S. per capita vegetable use (availability) increased 2 percent to 409 pounds. Except for pulse crops, all major categories exhibited increases. Recovering from a 6 percent drop in 2018, fresh-market vegetable availability (including potatoes) rose 4 percent to 198 pounds in 2019. In fact, 16 of the top 25 fresh-market vegetables posted gains in availability driven largely by increases for spinach, cauliflower, cabbage, carrots, green beans, and potatoes.

Harvested area for vegetables and pulses dropped 8 percent in 2019 to 6.2 million acres. Other than sweet potatoes, harvested acreage was reduced across the board, led by pulse crops and processing vegetables. Despite some pockets of untimely weather (e.g., early frosts, excess rain and heat) average yields across the sector managed to rise 6 percent, offsetting much of the impact of declining area. As a result, vegetable and pulse production declined 2 percent to 1.17 billion cwt.

Despite a reduction in harvested area, rising yields pushed fresh utilized production up 3 percent. Although yields were generally better for canning and freezing vegetables, processing output was down 6 percent from a year earlier.

Given reduced production in the face of good demand spurred by high employment and rising incomes in 2019, aggregate vegetable prices increased 11 percent led by rising prices for fresh- market vegetables. As a result, the collective value of production for vegetable and pulse crops increased 9 percent to $19.4 billion. Virtually all of this gain came within the fresh-market and potato sectors because the value of production declined for all other major vegetable categories including processing and pulse crops (down 20 percent).

On the export side of the market, although U.S. exporters continued to battle against the strong dollar and higher U.S. domestic prices, they managed to reverse the decline in exports in 2018 and posting a 4 percent gain in 2019. Exports to two of the top three destinations increased in 2019, with exports to Canada—the top destination—accounting for 45 percent of value. Given the strength of the dollar, it is not surprising that 2020 exports started off slowly with values down 5 percent from a year earlier over the first two months. U.S. trade will likely slow further over the next few months due to the pandemic-inspired global economic pause.

To read the full USDA report, click here.

For more information:

For more information:

USDA ERS

Tel: +1 (202) 694-5139

www.usda.gov