In the MY 2022/23, Egypt achieved a remarkable milestone by exporting a record volume of oranges to Spain, multiplying its exports manifold, as reported by EastFruit. This feat allowed Egypt to ascend to the premier position among orange suppliers to Spain for the first time.

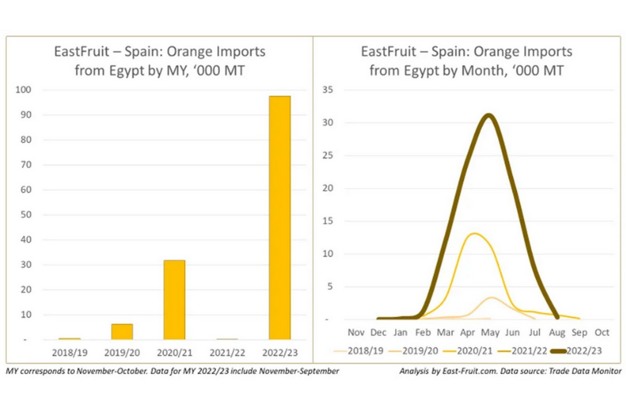

In the first 11 months of the MY 2022/23, from November 2022 to September 2023, Egyptian exporters delivered impressive 97,500 tons of oranges to the Spanish market, a stark contrast to the modest 25 tons supplied in the previous MY 2021/22. This represents a staggering 3904-fold increase in just one year!

The influx of Egyptian oranges into Spain commenced in January, with a significant surge in volumes starting in March and peaking in May. Shipments dwindled by August, indicating that the season’s final figures are unlikely to deviate substantially post-October data.

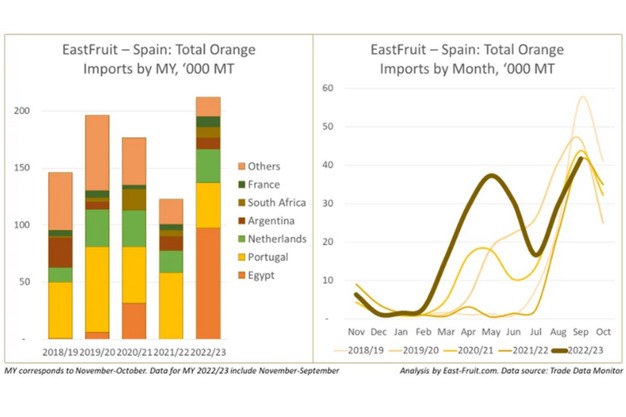

Egypt’s ascendancy in the orange export rankings is a significant development, surpassing traditional European competitors such as Portugal, the Netherlands, France, and others, as well as nations from the Southern Hemisphere like Argentina and South Africa. Historically, Portugal has been a dominant exporter to Spain, but in the MY 2022/23, Egypt’s exports more than doubled those of Portugal, with 97,500 tons compared to Portugal’s 40,000 tons.

Spain’s overall orange imports for the MY 2022/23 reached a new high, with the first 11 months already surpassing 210,000 tons. Notably, the import peak shifted from the typical August-October window to align with the active period of Egyptian exporters from March to June.

The surge in Spain’s orange imports is linked to a global downturn in orange production in 2022. FAS USDA data reveal a 5% drop in worldwide orange production for the MY 2022/23, totaling 47.8 mln tons. Spain, responsible for over half of the EU’s orange output, saw a 23% reduction in its harvest, down to 2.9 mln tons.

Meanwhile, Spain faced its lowest orange export volumes in years during the MY 2022/23, attributed to adverse weather conditions. Spring rains inundated key regions, followed by summer droughts and heatwaves. Additionally, broader economic challenges have prompted a shift among Spanish citrus growers towards more lucrative crops.

Meanwhile, Spain faced its lowest orange export volumes in years during the MY 2022/23, attributed to adverse weather conditions. Spring rains inundated key regions, followed by summer droughts and heatwaves. Additionally, broader economic challenges have prompted a shift among Spanish citrus growers towards more lucrative crops.

As the current season unfolds, orange prices in Spain remain relatively elevated. However, the World Citrus Organization (WCO) anticipates a recovery in Northern Hemisphere citrus production in 2023, potentially reversing the previous year’s market trends as early as this winter. Egypt’s forthcoming orange harvest is expected to surpass last year’s, prompting exporters to seek new markets. The increased availability of Egyptian oranges is likely to exert downward pressure on global prices.

For more information: east-fruit.com