July was another month of single-digit food and beverage inflation for U.S. retail. While the Circana (formerly IRI) sales numbers showed little to no response or improvement in volume sales across most departments, fresh produce was a powerful exception, according to Jonna Parker, team lead fresh with Circana.

Circana’s household engagement insights show the reason behind the overall down performance in food and beverages. Hyper-focused on sales specials, consumers are shopping more often and across more stores. At the same time, inflation continues to provide a small boost to the average shopping ring for most departments.

Circana’s July survey of 1,000+ primary grocery shoppers sheds further light on consumers’ reactions. Circana, 210 Analytics and the International Fresh Produce Association team up to document the impact on sales patterns in fresh produce.

Retailers invested in fruit prices in July. The average price per pound for fruit decreased by 1.0 percent over year-ago levels. Vegetables did sustain small price increases to the tune of 2.4 percent versus July 2022.

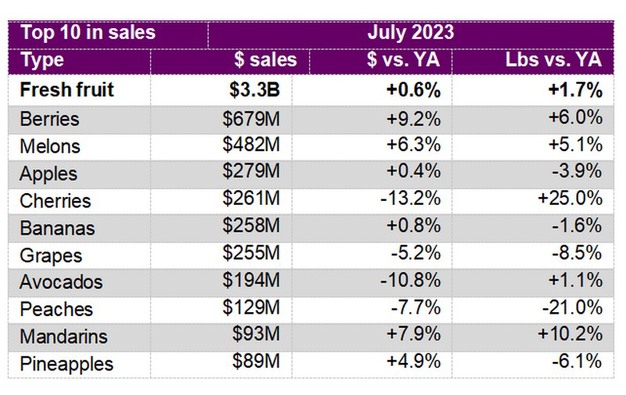

July 2023 fresh produce sales reached $6.2 billion. Weekly fresh produce sales averaged between $1.5 and $1.6 billion, with a slight bump for the holiday week. Pounds grew 4.5 percent over year-ago levels during the holiday week and the remaining weeks were right around year-ago levels.

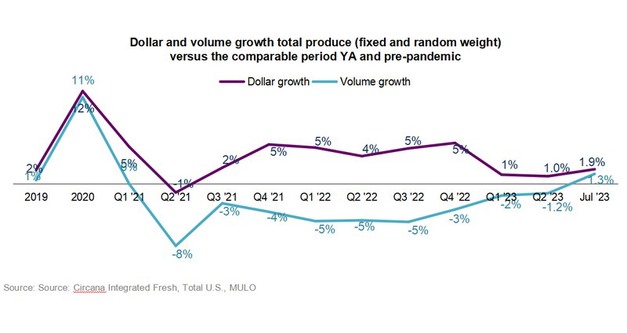

Produce dollar sales growth has been in the black ever since lapping the massive pandemic sales spikes in the second quarter of 2021. Produce pounds, on the other hand, have mostly tracked behind as shoppers are savvy in their ways to save.

The investment in price on the fruit side paid off in large volume gains of 1.7 percent over July 2022. Vegetables also experienced pound growth but at a more moderate rate of 0.8 percent.

“Berries’ July performance was outstanding,” said Joe Watson, IFPA’s VP of retail, foodservice and wholesale. “The four July weeks generated $679 million in berries with substantial dollar and pound gains. Cherries continued to trend in the top five with $261 million in sales, which was down in dollars, but up in pounds.”

Other items with increased volume sales were melons, avocados and mandarins.

“The dollar and pound performance among the top 10 vegetable sellers was all over the board,” Parker said. “Potato price inflation has slowed, but price increases continued to sit in the double digits, at 13.4 percent. Yet, pounds are virtually flat when compared to July 2022.

Corn remained in the top 10 in July--another seasonal powerhouse with more favorable pricing than last summer.

Berries took back over as the top contributor to absolute dollar growth after losing to cherries in June. Fruit added $19.6 million year-on-year and vegetables $89.5 million.

The next report, covering August, will be released in mid-September.

Click here to see the full report.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

[email protected]

www.210analytics.com