The deceleration of the rate of inflation continued in April 2023. “We found that the increase in the price per unit for total food and beverages averaged 8.2 percent in April 2023 compared with April 2022,” said Jonna Parker, team lead, fresh for Circana (formerly IRI).

Additionally, the temporary Supplemental Nutrition Assistance Program (SNAP) emergency allotments (EAs) — a temporary benefit increase that Congress enacted to address rising food insecurity and provide economic stimulus during the COVID-19 pandemic — ended in March 2023.

The April Circana sales results and survey of primary grocery shoppers underscore that economic pressure on income continues to result in consumers moving around dollars between channels, products and brands. Circana, 210 Analytics and the International Fresh Produce Association team up to document the impact on sales patterns in fresh produce.

The April Circana sales results and survey of primary grocery shoppers underscore that economic pressure on income continues to result in consumers moving around dollars between channels, products and brands. Circana, 210 Analytics and the International Fresh Produce Association team up to document the impact on sales patterns in fresh produce.

“The April report points to strengthening demand for fruit in reaction to sustained deflationary conditions and continued strength for many vegetables,” said Joe Watson, IFPA’s VP, retail, foodservice and wholesale.

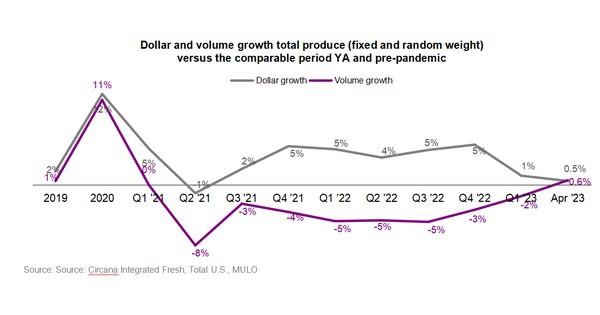

Prices for fresh produce were flat in April 2023 when compared to April 2022. Fresh fruit prices decreased by 2.4 percent compared to April 2022. Vegetable inflation averaged +2.3 percent in April--down from the 52-week levels that averaged +7.7 percent.

April 2023 fresh produce sales reached $5.9 billion. Weekly fresh produce sales averaged between $1.41 billion and $1.57 billion.

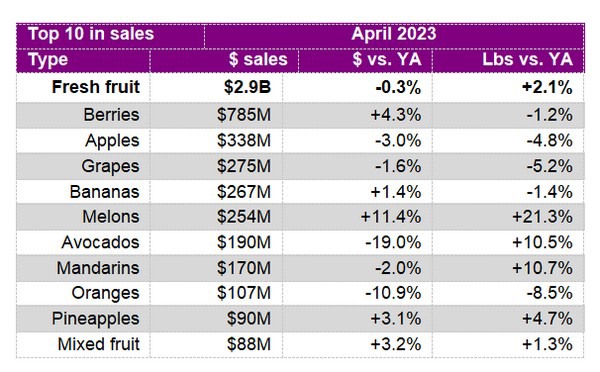

The increase in fresh produce volume sales was driven by fruit, which experienced a 2.1 percent increase in pounds sold in April 2023 compared with April 2022. Vegetables did not quite reach year-ago levels but moved within one percentage point of the April 2022 levels.

“Fruit sales were a mix of dollar gains and losses and a mix of unit gains and losses in April,” Parker said. “The average price per pound for avocados was down 26.6 percent in April 2023 versus April 2022. This prompted a year-on-year increase of 10.5 percent in pounds, but it meant dollar sales fell by 19.0 percent.” Other items with increased volume sales were melons, mandarins, pineapples and mixed fruit.

Items with increased dollar sales in April 2023 compared with last year were berries, bananas, melons, pineapples and mixed fruit.

“Vegetables experienced a more mixed performance in April,” Watson said. “Three items increased pound sales--onions, peppers and cucumbers.

In April 2023, fresh vegetables added $41.6 million in additional dollars versus April 2022 whereas total fruit lost $10 million year-over-year.

Berries were the biggest contributor to new produce dollars, followed by potatoes, melons and lettuce. Melons increased on the combination of inflation and increased demand, whereas the additional dollars for berries, potatoes and lettuce were inflationary gains.

The next report, covering May, will be released in mid-June.

Please click here to see the full report.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

[email protected]

www.210analytics.com