The onion hysteria in the region has led to a wave of export bans, and it reached Azerbaijan. As EastFruit analysts have already reported, the exports of very expensive onions were banned by Kazakhstan, Uzbekistan, Tajikistan, and Kyrgyzstan.

However, in the case of Azerbaijan, the wording of the government’s resolution is ambiguous. The Decree of the Cabinet of Ministers dated February 03, 2023 “On Amendments to the Decree dated March 18, 2022 “On Measures to Regulate the Export from the Country of a Number of Basic Food Products Included in the Minimum Consumer Basket and Goods Used for Their Production” states that the movement of onions and shallots in the customs territory of the country will be temporarily regulated.” It is hard to say what it means. Market participants say that “the export of onions from Azerbaijan has been prohibited since February 3.”

At the same time, onion import privileges were also introduced. By another decree, dated February 3, 2023, the government decided to exempt onion imports from import customs duties until May 1, 2023. But if all countries ban exports, this decision will not make any sense.

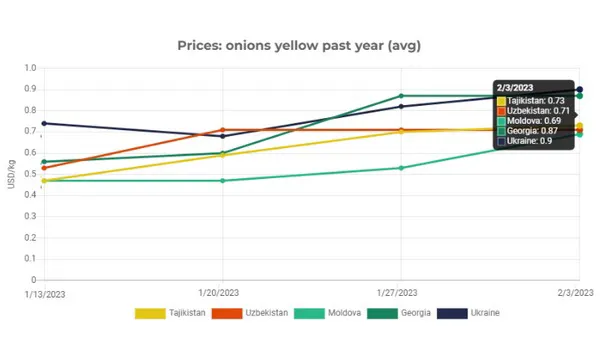

Meanwhile, tensions in the region’s onion market run high. As our weekly price review showed, onion prices kept rising in Moldova, Ukraine, Poland, and Tajikistan. Current wholesale prices for onions in Ukraine have already reached $0.9/kg. Prices in Moldova, Uzbekistan, and Tajikistan are in the range of $0.69-0.73/kg, and the prices in Georgia are close to those in Ukraine.

The bad news does not end there – we have published a mini-study on the upcoming harvest of early onions in Uzbekistan, which indicates a high probability of a delay in the start of early onion sales due to frost damage. Moreover, the yield and quality of early onions may be lower than expected.

So, our preliminary forecasts of a likely tense situation on the onion market in winter-spring have so far been confirmed. It is crucial for all producers to understand that high prices stimulate interest in this crop in the region. This has happened several times over the past 20 years, and almost every following year has been a disappointment for farmers.

Although Russian aggression against Ukraine is making its own adjustments to the normal cyclicality of the market, experts are urging Ukrainian farmers to be careful and balanced in planning the sowing areas for onions for the next season.

For more information: east-fruit.com